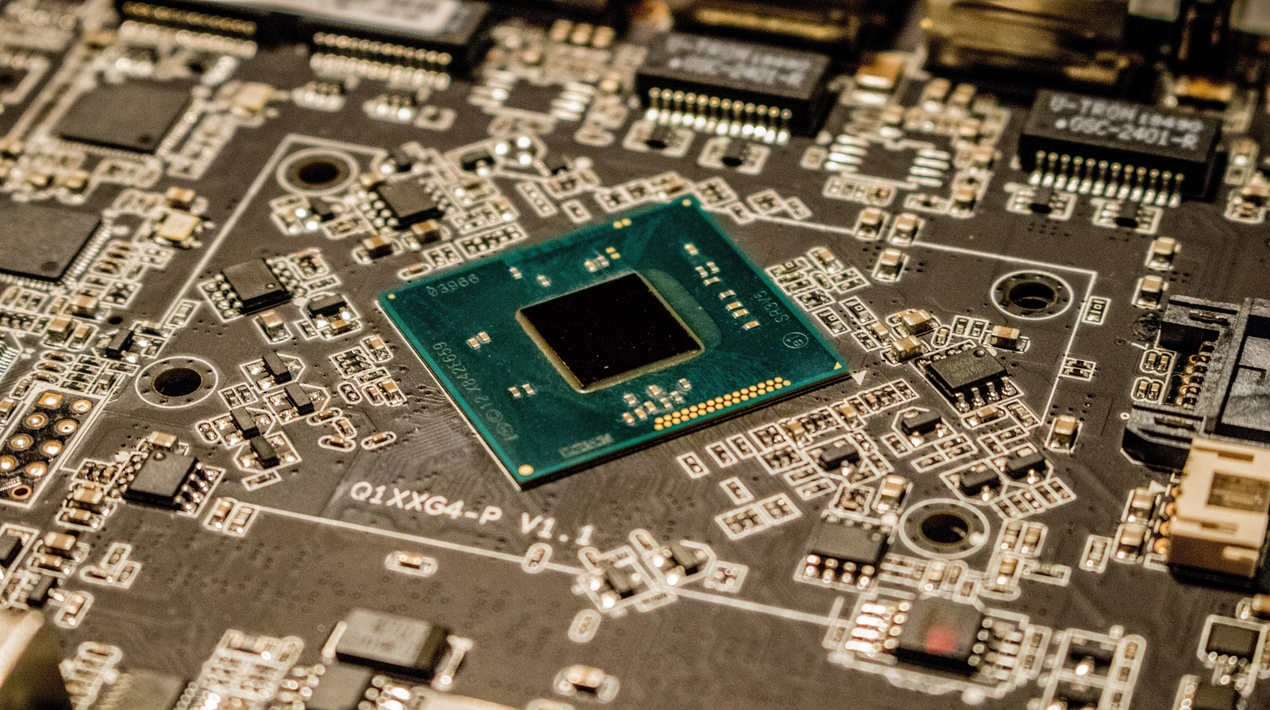

In an attempt to make India a hub for electronics, the government plans to provide incentives worth IN₹760 billion (approximately US$10 billion) towards setting up over 20 semiconductor designs, components manufacturing, and display fabrication (fab) units over the next six years. Through various PLI (production linked incentive) schemes, the centre has tried to broaden the scope of manufacturing and export from India while the semiconductor policy will help deepen India’s manufacturing base, according to a news report by The Economic Times.

The government’s target includes one to two fab units for displays and ten units each for designing and manufacturing components. Once the Cabinet approves the scheme, the Ministry of Electronics and Information Technology (MeitY) will work out the details and invite companies to invest. The report stated that globally, there has been a shortage of semiconductor chips, affecting production targets across almost all industries, including ones that manufacture smartphones, laptops, cars, and appliances.

An industry expert noted that the policy comes at the right time, given the ubiquitous uses of semiconductors; if the policy can attract foundries (fabrication units) to the country, it would go a long way in making the country self-reliant.

OpenGov Asia reported last month that MietY released Volume-I of a vision document on increasing India’s electronics exports and share in global value chains (GVCs). It outlined opportunities, challenges, and suggested policies for India to grow from US$75 billion (2020-21) to US$300 billion by 2025. Of the multi-billion-dollar target, nearly 40% would be from exports. The document is part of the Ministry’s target for India to have a US$1 trillion digital economy. The report explored ways to build large-scale manufacturing capabilities to occupy a substantial share in global electronics exports. It was created by the Indian Cellular Electronics Association (ICEA) in consultation with the industry. The electronics sector has the potential to become one of India’s top exports in the next 3-5 years along with several products for which export hubs could be created.

The MietY Minister has said that the industry needs to focus on expanding product categories to serve new markets and consumers. India has an “unprecedented opportunity” to grow electronics manufacturing to US$300 billion in the next 3-4 years, building on scale, competitiveness, a large market, and enabling policies. The geographical concentration of the electronics GVCs shows that most participants are in Asia, China and Vietnam are the most prominent. In 2020, China’s and Vietnam’s electronics exports were respectively 70 and 11 times that of India’s.

Attracting GVCs requires open trade and investment policies. Tariff and non-tariff barriers can deter the movement of component and sub-assembly manufacturers. Any constraint on investments will also be a barrier to attracting GVCs. Stability of policies, reducing delays in processes, and incentives, are key to attracting FDI and ensuring efficient operations. India’s policies should be WTO-consistent as the inconsistent ones can be challenged by competitors and create an uncertain investment environment.

The news report explained that the document is the first of a two-part series. The second volume will present product-wise strategies and forecasts as part of the campaign to build a US$1 trillion digital economy, in pursuit of reaching a US$5 trillion GDP. It recommends short-term (1-4 years) and long-term (5-10 years) strategies to increase electronics exports, shift the electronics manufacturing ecosystem investments, and expand exports by increasing competitiveness and scale.