The Asian Development Bank (ADB) has released a report

looking at how finance and technology

can aid the positive impact of migration on home countries.

According to the

report, around 75% of global remittances projected in 2017 ($443 billion out of

$593 billion) came from developing countries, particularly in the East Asia and

Pacific and South Asia regions. The World Bank estimates that the number will

continue to grow by 3.5% to $459 billion by 2018.

The report notes

that the remittances have a significant development impact. They increase

household income which can be spent for social services such as education and

health. In addition, they can contribute to financial services expansion and

drive growth of inclusive finance.

But these benefits

are hampered by high costs which impact the efficient flow of remittances.

Though the costs are declining, they remain at 14%-20% for all developing

regions. The worldwide average cost of bank transfer is 11%, a slight decline

from its 2008 level of 14.6%. The average costs for IMTOs (international money

transfer operators) are lower at around 6%, with post offices’ being 7%.

Remittance costs in

Asia have gone down to 8%, but are still above the global average (7.4%) and

the targets set by the United Nations’ Sustainable Development Goals (3% by

2030). A 5% decline in remittance costs could generate $15 billion in savings.

Information and communication technologies could play a key role in this area.

The basic mechanism

of cross-border remittance transactions, built around correspondent banking

relationships, hasn’t changed much during the past few decades. Most recent

innovations focus on repackaging efficiencies within the international financial

infrastructure according to the report.

Dependence on

back-end clearing and settlement entities adds opacity to remittance cost

structures. The report also notes that fluctuating foreign exchange rates obscures

the costs further, as the disclosure or estimation of such rates varies across

remittance service providers (RSPs).

Potential impact of digital technologies

Currently, purely

digital cash-in solutions cater to high-income sending to middle- and

low-income country corridors. The solutions can lead to substantial savings as

demonstrated by the 1% flat fee of TransferWise [1], but the benefits are limited to people who can deposit by local

bank transfer, debit or credit card (in select currencies), or SWIFT

international transfer. Savings with other providers are often similarly confined

to that sub-segment.

Access to digitised channels,

has not yet fully translate to usage. Obstacles include to inadequate value

propositions for merchants, weak stakeholder economics for card networks,

insufficient aggregate customer demand, inconsistent infrastructure and

regulatory frameworks, ineffective distribution models, and reluctance to pay

full taxes on previously unreported revenues.

The authors of the

report expect physical currencies to remain as the fallback for situations

where electronic acceptance is not available, either because one party lacks

the proper means, or they find it uneconomical, inconvenient, or both.

Some Fintech players

are seeking to consolidate and/or replace parts of the legacy remittance value

chain, while others want to reconfigure it in a more fundamental fashion.

The report

classifies Fintech propositions based on scale and scope of impact.

Status Quo Plus: Traditional

IMTOs using the well-established infrastructure of intermediary banks and

bilateral agreements along with SWIFT and focusing on optimising cash-in,

cash-out. Digital services may bring efficiencies, but are reliant on existing

core financial infrastructure.

Improved

Fundamentals: Here, international IMTOs seek to leverage their massive scale to

bring fixed cost efficiencies. An alternative model is to use aggregation with hubs

managing the corridors; multinational “borderless accounts” with providers

doing net transfers across their international accounts.

New Paradigm: The

objective here is to move toward significanty lower, even zero-fee services. These

companies are also exploring new revenue sources, such as user insights and

targeted advertising. Some are trying to leverage cryptocurrencies for

disintermediation and open APIs to make for more democratic access.

According to the

report, the third cluster of innovative technologies and business models could

prove especially disruptive and may require a complete reworking of the

existing competitive environment.

Decentralised

cryptocurrencies and distributed ledger applications could potentially address

the backend opacity. Blockchain-based solutions can provide granular transaction

history. They will also provide visibility of cross-institutional data by

numerous parties in real time, along with cash-out opportunities through

strategic partnerships. The distributed nature of access, would hinder any

attempts to falsify records.

Cryptocurrencies

could theoretically render intermediary banking infrastructure unnecessary.

Digital assets might then be transferred between two parties without external

permissions, which is then moved over a cryptocurrency’s secure network to the

receiver. However, the perceived illiquidity and volatility of cryptocurrencies

remains a challenge.

Central bank digital

currencies (CBDCs)

could produce a peer-to-peer (P2P) transfer network whose value would be

anchored by its 1:1 exchangeability with the other liabilities of a central

bank, cash, and reserves. CBDCs could also help to universalise a technological

standard for electronic payments.

The report cites the

Monetary Authority of Singapore as a pioneer experimenting with a

state-controlled cryptocurrency. Its Project Ubin has placed the tokenised

form of the Singapore dollar on a distributed ledger, the first of its kind

in Asia.

Interbank

distributed ledger technology applications, more widely, could bypass

correspondent banking and promote direct settlement between financial

institutions. Ripple recently announced that over 100 financial institutions

are now active on its enterprise blockchain network RippleNet, wherein

in-network banks can initiate and settle wholesale payments through

cryptotokens. IBM, Mastercard, JPMorgan, SWIFT, the Gates Foundation, R3CEV,

and more are all competing to establish a distributed ledger platform for

cross-border international payments.

At the moment though

these initiatives represent only a tiny sliver of cross-border flows. A consensus

has to be reached by all stakeholders over the utility of either

cryptocurrencies or distributed ledgers for realizing the large-scale

structural impact of the technology.

Government’s role

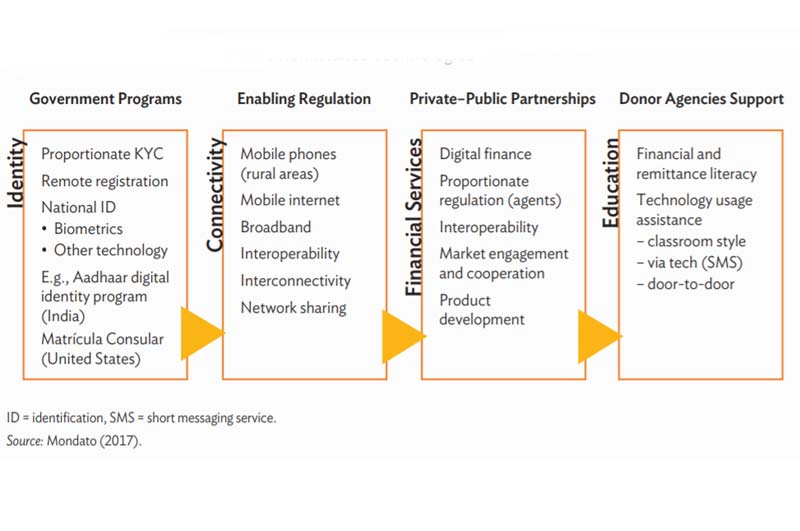

The report notes four

ways in which governments can play an enabling role for digital transformation of

remittances and driving greater financial inclusion.

Firstly, governments

can develop national IDs, potentially including biometrics and other

technologies. Examples include the Aadhaar digital identity program in India or

the Mexican Matrícula Consular in the US.

Initiatives such as

universal coverage programs for rural mobile broadband can facilitate wider

access to digital remittance channels.

Appropriate

regulation of distribution channels would also be important. The report states

that agents should be regulated on a risk-proportionate basis, as heavy

licensing and compliance requirements can limit their footprint and exclude the

local merchants that have been typical of mobile money. Interoperability can

help establish critical.

National awareness

campaigns, financial and remittance literacy, and technology usage assistance

(e.g., classroom-style sessions, via SMS, or even door-to-door) can be organized

through public-private partnerships and with possible donor agency support.

[1] Transfer-wise avoids currency exchanges

by rerouting money domestically. A euro outbound remittance is used to fund a

euro in-bound remittance.

Read the report, Labor Migration in Asia, Increasing the

Development Impact of Migration through Finance and Technology’ here. The section on 'Leveraging Remittance Technologies for Financial Inclusion in Asia' is available here.