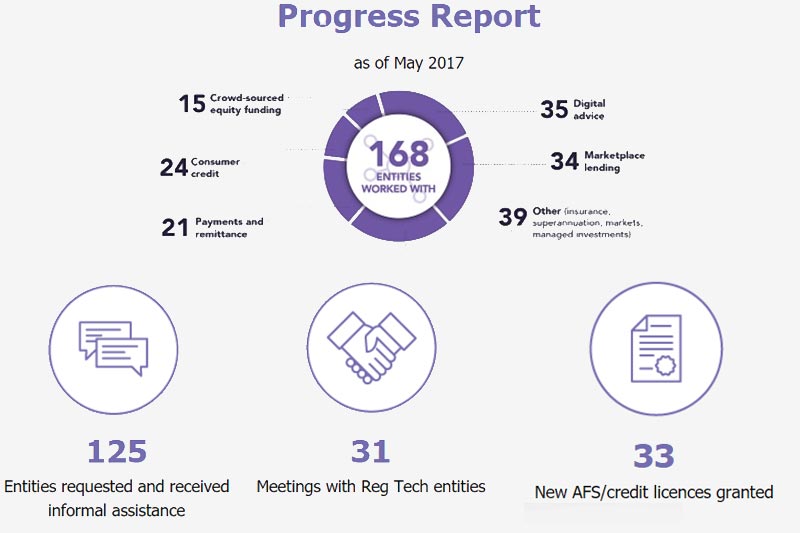

Progress report on ASIC's Innovation Hub, as of May 2017

The Australian Securities & Investments Commission (ASIC1) released a report on last Friday, discussing the regulator’s possible future approach to regulatory technology (RegTech) and providing updates on the work of ASIC’s Innovation Hub. The Innovation Hub was launched in March 2015, to help innovative FinTech businesses navigate the regulatory framework. In mid-2016, the scope of the Innovation Hub was expanded to include engagement with RegTech.

RegTech initiatives

ASIC has proposed a number of new initiatives in the report, building on ASIC’s existing regtech activities, which include the provision of informal assistance to RegTech entities through the Innovation Hub, engagement with the sector at meet-ups and related events, international cooperation and referrals, and a range of existing technology trials.

The first one is to establish a RegTech industry liaison network, comprising industry, technology firms, academics, consultancies, regulators and consumer bodies, with ASIC playing the role of enabler, convener and catalyst. The group is intended to enable networking, discussion of RegTech developments and collaboration opportunities that promote positive applications of RegTech.

ASIC is also committed to conducting new trials, leveraging RegTech technologies in ASIC's regulatory, supervisory and enforcement work. ASIC would update the market and share knowledge on the new RegTech applications to promote wider use of technologies that promote good consumer and market integrity outcomes.

There are also plans to organise a problem-solving event or a 'hackathon later in 2017, in collaboration with industry. The event is expected to catalyse thinking and approaches to deal with regulating problems commonly faced by the financial sector and looks to the sector to help identify potential challenges to solve. It would also help identify potential roadblocks in uptake of the technologies and growth of the sector.

Update on regulatory sandbox

ASIC’s regulatory sandbox framework was launched in December 2016. The framework was designed to complement ASIC’s existing framework (which has significant flexibility) and exemptions already provided by the law or ASIC for licensing requirements (e.g. for non-cash payment products like stored-value cards). The framework provides additional guidance and examples on how ASIC exercises discretion under existing policy to assess the organisational competence of a licensee applicant and modifies ASIC’s policy on a licensee’s organisational competence for some limited-in-scale, heavily automated businesses.

The ultimate objective is to promote innovation by reducing red tape without fundamentally compromising consumer protections, such as conduct and disclosure standards, dispute resolution and professional indemnity insurance.

ASIC has also introduced a world-first class waiver that allows eligible businesses industry-wide to test specified services for up to 12 months without an Australian financial services or credit licence, provided they also meet certain consumer protection conditions and notify ASIC before they commence the business.

This is a white-list approach as ASIC will not review each proposed test. This is in contrast to sandbox proposals in other jurisdictions which have involved the regulator selecting applicants and negotiating individual testing terms. The first entity can make use of the class waiver FinTech licensing exemption from mid-May.

ASIC Commissioner John Price said, “ASIC is committed to supporting developments in the regtech sector and a key aspect of our approach is to learn from industry input as well as good international case studies and our own experiences engaging with the sector.”

“ASIC believes regtech can help organisations build a culture of compliance, identify learning opportunities and save time and money relating to regulatory matters, while improving compliance and outcomes for consumers. Our goal is to see the community benefit from these new technologies whilst minimising any potential risks,” he added.

In its 2017-18 Budget, the Australian government expressed commitment to establishing Australia as a leading global financial technology (FinTech) hub and announced a number of policy measures to support innovation and growth in the FinTech industry.

Read the report, ‘ASIC’s Innovation Hub and our approach to regulatory technology’ here.

1ASIC is Australia’s corporate, markets and financial services regulator.