The Bank for International Settlements (BIS), an international financial

organisation owned by 60 member central banks, has released a report analysing the

impact of potential central bank digital currencies (CBDCs). The report offers

a high-level overview of the implications of CBDCs for payments, monetary

policy and financial stability.

Several central banks have started exploring the idea of

issuing their own digital currencies. They are motivated by Fintech developments,

the emergence of new entrants into payment services and intermediation, declining

use of cash in a few countries and increasing attention to private digital

tokens.

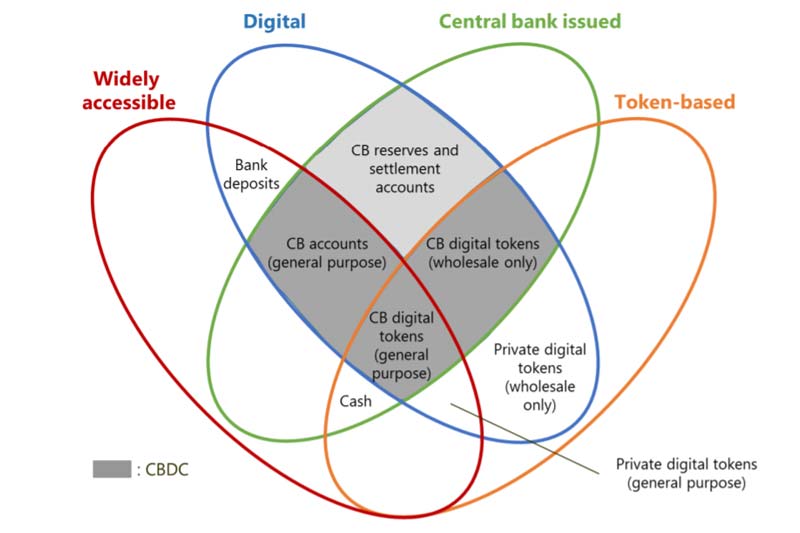

The authors note that central banks already provide digital

money in the form of reserves or settlement account balances held by commercial

banks and certain other financial institutions at the central bank. So, a

central bank liability, denominated in an existing unit of account, which

serves both as a medium of exchange and a store of value would be an innovation

for general purpose users but not for wholesale entities. Hence, it would be

easier to define CBDC as a new form of digital central bank money that can be

distinguished from reserves or settlement balances held by commercial banks at

central banks.

There are various design choices for a CBDC, including: access (widely vs restricted); degree of anonymity (ranging from

complete to none); operational

availability (ranging from current opening hours to 24 hours a day and

seven days a week); and interest-bearing

characteristics (yes or no). Each combination has different implications.

ability of the payee to verify the validity of the payment object such as the cash or digital coin, whereas systems based on account money depend

fundamentally on the ability to verify the identity of the account holder.)/ Credit: BIS

Traditionally, central banks have tended to limit access to

(digital) account-based forms of central bank money to banks and to certain

other financial or public institutions in some instances. This is in contrast

with physical central bank money (cash), which is widely accessible.

This BIS report looks at two variants, a wholesale and a

general purpose one, differentiated by their accessibility, with the former

being limited a pre-defined group of users and the latter being widely accessible.

Impact on payments

While, wholesale CBDCs, combined with the use of distributed

ledger or blockchain technology, may enhance settlement efficiency for

transactions involving securities and derivatives, currently proposed

implementations do not exhibit clear superiority over existing infrastructures.

More experimentation would be required before central banks can usefully and

safely implement new technologies supporting a wholesale CBDC variant.

On the other hand, a general purpose CBDC, widely available

to the general public, could provide a safe, robust and convenient alternative payment

instrument in jurisdictions where the use of cash is declining. However, the

report says that similar benefits could be achieved through fast or even

instant and efficient private retail payment products that are already in place

or in development.

Certain challenges in the issuance of a general purpose CBDC

are also highlighted. A central issuing such a CBDC would have to ensure the

fulfilment of anti-money laundering and counter terrorism financing (AML/CFT)

requirements. An anonymous CBDC could be widely used globally, including for

illegal transactions. A non-anonymous CBDC allowing for digital records and

traces, could improve addressing AML/ CFT requirements. But then such a

traceable CBDC would not necessarily be the main conduit for illicit transactions

and informal economic activities.

In some CBDC designs the “know-your-customer” (KYC) function,

along with its associated costs could fall to the central bank, for which they

might not necessarily be well-equipped. They could also be called upon to

provide information to tax and other authorities. Moreover, central banks would

have to manage privacy and anonymity issues arising from the insights obtained

from private transactions.

Some of the proposed technologies for issuing and managing

CBDC, such as DLT, are still in early stages of testing and questions

surrounding operational risk management and governance have to addressed before

deployment can be envisioned.

There is also the issue of cybersecurity to be considered,

as a general purpose CBDC is open to many participants and hence to many points

of attack.

Impact on monetary

policy

Since digital central bank money is already available to

monetary counterparties, the report only looks at the implications of a widely

available CBDC for implementation and transmission of monetary policy. This

will be dependent on its accessibility and on whether it is attractively

remunerated through interest. These factors would determine the substitution effects

of CBDC on different types of financial assets.

CBDCs could strengthen pass through of policy rate changes (such

as banks adjusting interest rates in line with movements in benchmark rates by

central bank). However, the authors highlight that the degree to which key

market rates move in conjunction with the policy rate appears to be satisfactory

for most central banks. Furthermore, alternative tools are available which could

meet the same objectives.

Impact on financial

stability

In times of systemic financial stress, households and other

agents shift their deposits towards financial institutions perceived to be

safer and/or into government securities. A CBDC could enable “digital runs” towards the

central bank with unprecedented speed and scale. The benefits of deposit insurance

and the stability of retail funding could be weakened, as because a risk-free CBDC

provides a very safe alternative. Even stronger banks could face withdrawals in

the presence of CBDC.

This effect could be amplified if the CBDC is available

cross-border. Exchanging a CBDC for an international currency could potentially

enable faster deleveraging in capital markets, resulting in tight funding

conditions and sharp movements in foreign exchange markets.

In general, the introduction of CBDC could blue distinctions

between residents and non-residents and domestic and foreign transactions. This

would lead to a variety of complications. For instance, it could be more

difficult to apply AML/CFT requirements because of lack of formal powers over

intermediaries involved in token-based CBDC distribution. Similarly, if foreign

banks were able to purchase, receive or otherwise hold “domestic” CBDC, they

could use the CBDC to provide the functional equivalent of “offshore” accounts

and payment services denominated in the domestic currency.

Cross-border availability of CBDCs could increase

substitution away from the domestic currency, which could make monetary

aggregates unstable and alter the choice of monetary instruments.

The authors note further that the introduction of CBDCs by

jurisdictions with international currencies could reinforce existing costs and

benefits.

Hence, the authors advise that central banks that have

introduced or are seeking to introduce a CBDC should take due consideration of relevant

cross-border issues. In addition, they advise that central banks and other

authorities should continue monitoring digital innovations, along with their

potential impact on their own operations and continue to engage with each other

closely.

Read the complete report here.