Today, financial institutions have the ability to gather, store, aggregate and analyse a broader variety of client data, ranging from their current or former location to consumer behaviours and preferences, which has been enhanced as a result of technological advancements. This, in turn, enables organisations to build, optimise and secure digital interactions from frontend to backend, across the full technology stack.

The most accurate way to enhance customer experience is the use of insights from data. By harnessing data-driven insights, banks can deliver on their core promises: to listen to customers, create a service that benefits them and offer that service in a personalised way.

In this scenario, data becomes one of the most valuable assets in digital banking and key financial system designs must incorporate a frictionless process layer so that banks can deliver better digital customer experiences.

Thailand has put in significant efforts in digitalising the financial and economic sectors. Currently, the nation is leading the world for mobile banking and financial services apps. It also ranks in the top five countries for e-commerce adoption, mobile payment, mobile commerce and QR code usage.

Embracing digital transformation as a strategic goal is the need of the hour for banks operating in Thailand to compete with larger incumbents. This can be accomplished by combining the various data silos that exist on-premise, in hybrid cloud environments, or multi-cloud environments and distilling these data into actionable insights to guide executive decisions.

Over the last few years, the cloud has enabled scalability in the finance industry, delivering agility. Financial institutions can acquire and analyse varied types of data at incredible speeds, eliminate content silos, safeguard data across the bank and develop enduring relationships with clients thanks to the greater flexibility and scalability of cloud solutions over on-premises systems.

To provide a customised, customer-centric experience, financial institutions must use data, analytics, technology, and automation effectively. The new ‘Data-to-Everything’ approach is required to manage these technical and organisational challenges. Financial institutions must embrace this because it benefits business, IT, and security teams by collecting real-time data from all sources, applying analytics and intelligence, and triggering automated actions that reduce business risks, improve security, provide collaboration, accelerate decision making, improve the customer experience and generates more business opportunities.

A digital-first, cloud-first and customer-first strategy is the future. Any digital banking strategy must be supported by a strong data strategy. To drive a high-level digital transformation, financial institutions must leverage insights to inform decision-making, operations, and customer experience components.

The OpenGovLive! Virtual Breakfast Insight held on 21 January 2022 aimed to provide the latest information on delivering an effective and efficient customer experience, and how financial institutions must leverage data-driven insights to inform decision-making, operations, and customer experience components.

Accelerating a digital strategy to provide a transformative financial experience

Mohit Sagar, Group Managing Director and Editor-in-Chief, OpenGov Asia, kicked off the session with his opening address.

Mohit contends that technology is being in all spheres of life at a faster pace than ever before. Digital transformation is the ‘latest buzz word’ used by everyone across the world in every imaginable area and sector. Retail, financial, and public sectors have been rapidly rolling out new IT, tech software and solutions to survive and thrive in the digital age.

No doubt, the COVID-19 outbreak was a key factor in shifting the banking business landscape. In an article he wrote recently, Mohit says there is more pressure on the financial sector in Thailand to be digitally ready to meet demand and customer needs, to have a robust infrastructure in place and a strong data strategy.

In light of the pandemic and the new normal, Mohit asserts that there is a pressing need to accelerate digital strategies. With remote working models in place, people have grown accustomed to accessing information at any time, on any platform and with any device. The retail industry took the lead in embracing personalisation and transformed itself in a variety of ways, including accessibility, options, ease of doing business and security.

“Customer experiences have changed,” Mohit claims. “There is a steep rise in expectations for personalised and seamless services. If an organisation or agency does not meet these, they will explore other options.”

This means that organisations need to create new cloud and data strategies and innovate in every aspect. To successfully and efficiently do this, he emphasised the importance of partnership to leverage data and cloud computing in an organisation. By partnering with the right people, a company can accelerate its digital journey towards digital transformation.

Multi-cloud solutions in powering financial services

Dan Brassington, Chief Technical Advisor, APAC, Splunk spoke next on adapting and tweaking strategies to meet client needs and expectations. “Every organisation needs to be a digital organisation, powered by data, running in a multi-cloud world,” he firmly believes.

To have a competitive advantage, organisations need to consider how to leverage data and operationalise security across hybrid and multi-cloud environments – to build, detect, validate, contextualise and prioritise alerts, as well as reduce time to detect, streamline investigations to respond rapidly.

While charting the roadmap might seem easy in theory, the reality of digital transformation is that it is hard, complex and the journey is long. It is as much about working on processes and people as it is about the technology, Dan emphasised. On this journey of digital transformation, “there is no end state but a future state,” Dan opines.

Regardless of where organisations are on the path to digital transformation, the general trend is that they are applying technology across the business in new and broader ways. Whether organisations are attempting to control costs, open new revenue streams, make their workers and internal processes more efficient or build that “Next Great Thing,” the business objectives that they are trying to use technology to solve for are closer to the centre of their core business than ever before. In some cases, it may even be redefining the organisation’s identity.

On customer experience, Dan believes that customers expect organisations to understand their behaviour, their likes and dislikes and to move at their speed – if an institution is not able to do so, customers will find someone who can. Maintaining a competitive advantage is, therefore, imperative.

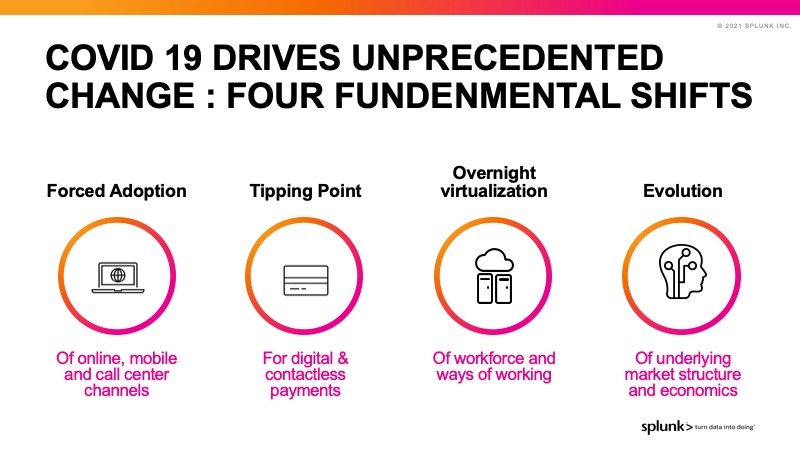

COVID-19 has driven 4 fundamental shifts, Dan observes. The first is the forced adoption of online, mobile call centre channels. That is followed by the arrival at a tipping point for digital and contactless payments, the overnight visualisation of the workforce and ways of working and the evolution of underlying market structure and economics.

The fact of the matter is that all the innovation and transformation is so that businesses can meet their customers’ expectations and provide smooth experiences in a bid to maintain their competitive advantage. Data is central to powering the experience of digital channels in ways that organisations need to look into.

To stay ahead of the curve, organisations must harness insights derived from data and the software that drives the digital experience. The ability to deliver data-driven digital services faster and cheaper is the key.

Beyond a doubt, the future is digital and digitalisation must take place across the entire value chain and the new environment. For instance, financial institutions cannot simply provide a mobile application per se – the provision of that service must come with the ability to provide streamlined processes of accessing services, such as approving home loans in 24 hours and providing quick financial services.

It is important to bear in mind that the hybrid and remote workforce is the future, Dan is convinced. This requires people, operations, and culture to be reimagined. And in this rapidly changing and demanding environment, innovative approaches must also be created for organisations to tackle inherent cyber risks and compliance risks.

Another important aspect of the digitalisation journey is the building of a cloud strategy. “Cloud is not a place but an operating model,” Dan highlights.

In conclusion, modern technologies will transform the future of business and data will fuel it. Data is the competitive advantage that businesses need to build to properly understand their customers and business. Businesses must evolve. Concluding his presentation, Dan shared 5 areas that are pressing for organisations to consider:

- Enable business model transformation and think differently about how businesses are run

- Identify industry changes early

- Optimise Resource Allocation

- Access, automate and accelerate data usage across the whole organisation

- Build a strong data-driven foundation for businesses

Using data-driven insights to accelerate businesses

Johnson Poh, Head Enterprise AI and Data, UOB Singapore, elaborated on the fundamental concepts of data analytics, as well as how financial institutions can enhance their business value and operational efficiency.

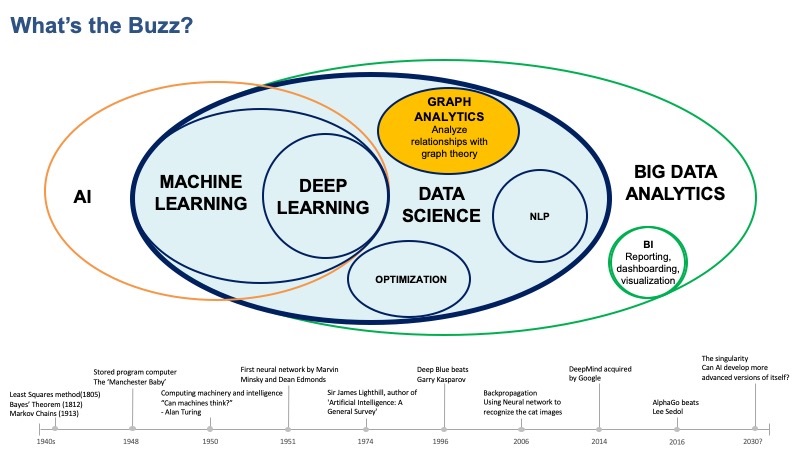

“What is the buzz surrounding AI, big data analytics and graph analytics?” Johnson asks.

But before the questions can be answered, the context and terms need to be unpacked. Breaking down the various related concepts, Johnson articulates the technologies underpinning data science.

- AI is a broad concept that relates to any technique that enables the machine to mimic human behaviour – it is about building smart machines to facilitate human efforts.

- Big data analytics pertains to the use of qualitative and quantitative methods and computing tools to derive insights from large volumes of data from a variety of sources at high velocity. It is an interdisciplinary field that focuses on advanced implementations for predictive and prescriptive analysis, comprising techniques such as Natural Language Processing (NLP) and Graph analysis.

- Machine Learning refers to a suite of AI techniques that allows computers to learn from data without being explicitly programmed to do so.

- Deep Learning is a subset of machine learning and refers to more advanced algorithms based on multi-layered artificial neural networks.

According to studies, big data can generate revenue on annual basis and enhance efficiency. Mckinsey estimates that big data analytics can create between US$ 4 to US$ 6 trillion in value annually, while another source reveals that banks can expect potential savings between 20% to 25% using big data analytics.

In the context of financial institutions, Johnson provided examples of how big data analytics can transform the banking and financial industry with impact – Anti Money Laundering (AML) management and fraud detection, recommender systems, customer 360 view and cybersecurity.

On Anti-Money Laundering management and fraud detection, he shared that big data analytics allows banks to sift out the underlying transactions and the relationships of fraudulent entities by mapping accounts and fund flows. By leveraging big data, the human task of investigating fraudulent transactions can be streamlined by prioritising the transactions that matter.

Another application of big data analytics includes recommender systems. It can also empower sales teams and analysts to have a comprehensive and unified view of customers and their journey map. With a fuller view of the customer journey, financial institutions can offer personalised and targeted services by analysing the preferences and profiles of customers. By offering a customer 360 view, the technology allows institutions to leverage linkages and relationships and to make connections that can inform operational decisions.

In terms of cybersecurity, Johnson shared that large corporate organisations face challenges in detecting real-time activity and transactions seamlessly. As data increases and operations scale, big data analytics offers a solution in sifting out critical data.

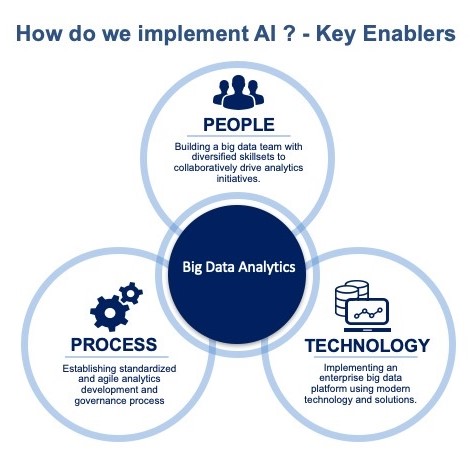

Developing people involves building a big data team with diversified skillsets to collaboratively drive analytics initiatives. For big data development at scale, a well-defined process and a set of standard operating procedures are imperatives.

Johnson has categorised the enterprise analytics lifecycle into three main phases: Big Data Engineering, Data Analytics & Machine Learning, Visualisation and Consumption. He points out that the process includes a feedback loop, emphasising that big data solutioning is an ongoing process requiring continuous monitoring, feedback, and refinement to account for performance degradation over time.

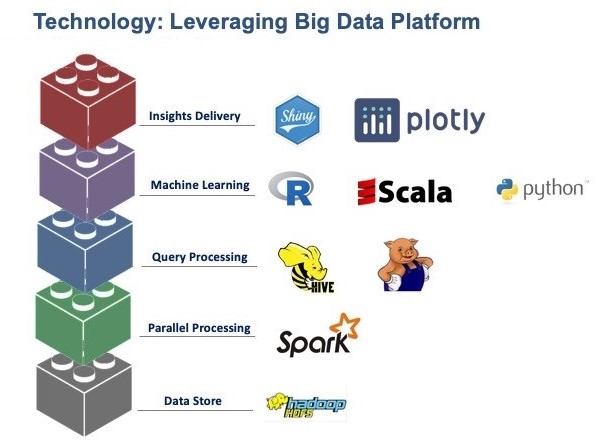

The final enabler is technology. To support the AI-driven pipeline, there is a need to assemble a suite of tools to fulfil the requirement for data storage, parallel processing, query processing, machine learning and insights delivery.

Concluding his presentation, Johnson reiterated the different use cases of big data technology in financial institutions and emphasised how it can benefit the operations of financial institutions, generate revenues and save on costs.

Interactive Discussion

After the informative presentations, delegates participated in interactive discussions facilitated by polling questions. This activity is designed to provide live-audience interaction, promote engagement, hear real-life experiences, and facilitate discussions that impart professional learning and development for participants.

The first poll inquired on the maturity of delegates’ cloud strategy. Over two-thirds (65%) indicated that they have defined a cloud strategy and are starting to implement cloud. There were 17% who are still evaluating cloud and experimenting with different options while 13% had a comprehensive cloud strategy and far were ahead in its practical implementation.

On being asked by Dan if they felt that the implementation was the difficult part, one delegate replied that they undertook design thinking before focusing on the customer and experimented with applications on cloud, focusing on data-driven operations.

Another delegate felt that adopting and implementing cloud strategy is a continuous learning process. In a similar vein, an executive managing the business interests of his organisation shared that his department is learning about cloud strategy. While he finds the changes to be slower in the financial sector, he recognises the unique limitations and concerns about security in the financial sector. He added that resources and skills are limited, which places a cap on how the organisation can capitalise on technology.

In response to Dan’s query about the main challenges that organisations faced, one participant said that it is a combination of technology limitation, lack of expertise and nervousness surrounding doing new things. To that, Dan echoed Johnson’s point that the three elements of people, process and technology need to come together and emphasised the importance of working with partners.

When asked about the main driver for data analytics and data-driven capabilities within their organisation, approximately half of the delegates (54%) indicated that they are keen to gain better insights and to create a personalised customer experience. The remaining delegates (46%) thought that the main driver is to generate additional revenue through highly targeted marketing strategies.

For Dan, the drivers are interlinked – gaining better insights and creating a personalised customer experience can lead to revenue generation. After acquiring customers, organisations need to understand them and retain them by driving the customer experience.

One delegate concurred with Dan’s point of view but added that as a bank, he has an obligation towards regulators who have non-revenue related concerns.

On the challenge organisations face in obtaining data insights, most delegates (42%) ranked disparate data sources from multiple data silos as the main challenge. This was followed by the shortage of staff who understand big data analysis (38%), data storage and quality (20%).

In response to the results, Johnson opined that challenges can be classified as the elements of people, process, and technology. He observes that in the context of the banking sector, a large part of the challenge comes from having to implement the right systems that are secure to manage customers to ensure that it is safe – the mindset of how technology should be harnessed is a big part of it.

Quality of data was another issue that a delegate pointed out – some data sits on-premise or cloud and others are in the data lake. In that sense, synchronising the data is an ongoing process that needs to be tackled. Other delegates opined that finding data scientists who possess the contextual knowledge to extract relevant insights to drive business is a challenge.

The next poll asked delegates about where they stood and what their next steps are in their digital transformation plan. For almost half (48%), the digital transformation journey has just started, and they are looking at tools, data, processes and channels. Over a fifth (22%) said they are mature on the digital transformation journey and are looking at how to drive the customer experience and top-line growth. The remaining delegates are either between the early stage of building a digital transformation plan (17%) or require help to drive the business use case of digital transformation across the business (13%).

A delegate shared that his organisation might be mature in terms of digital banking but that there is still a long way to go when it comes to organisation-wide transformation. For a small bank like his, the challenge lies in acquiring new customers.

In contrast, another delegate from a company with many entities shared his challenge of synchronising the digital channels and initiatives of the various entities. The difficulty lies in looking at the initiatives across platforms and deciding what ought to be consolidated and kept separate.

On the topic of customer-centric organisations being structured around the experiences of customers, most delegates (52%) agreed that they design and offer the right services, products and experiences to the right customers. About 20% felt that they are a collaborative organisation, where top-down and bottom-up decisions are aligned. The remaining votes were evenly split between the perception that they understand the people who bank with their institution – the market, types of customers and how the needs of customers differ (14%) and ensuring that customer requirements are filtered through to capabilities – as such, processes, capabilities, and systems are systematically aligned to customer needs (14%).

Regardless of the selection, Dan reiterated that there is no end-goal to digital transformation, only a future state digital transformation that is constantly evolving. Johnson added that all options are relevant, but it comes down to resource allocation and overall prioritisation.

Mohit agreed with Johnson that it is a complex topic because the banking sector has been challenged every step of the way, but that technology is an enabler for any organisation’s digital transformation.

The final poll asked delegates the main challenge they face when implementing digital strategy. Most of the delegates (56%) found the biggest challenge to be the legacy technologies lacking integration capabilities, followed by inflexible business processes and teams (22%), lack of properly skilled teams (17%) and regulatory constraints (7%).

Conclusion

In closing, Dan expressed his gratitude for the robust participation and highly energetic discussion. He observed that everyone was at a different stage of digital transformation and that technology is the key enabler that will help organisations to transform the hardest tasks in the organisation. The more an organisation can collect and leverage its structured and unstructured data, the more the business will be able to expand.

He emphasised the importance of partnering with colleagues within the organisation. He encouraged delegates to continue the conversation with the business department to understand what they need. Instead of being reactive to changes on the ground, it is better to be proactive.

Dan reiterated that learning about data is a continuous and ongoing journey and encouraged the delegates to connect with him and the team to explore ways in which the use of data can help agencies improve their operations.

Mohit brought the session to an end with a final remark that the banking sector is under tremendous pressure because of the tremendous competition. He also added that while technology is the enabler, people and skill sets are critical to the implementation of digital transformation initiatives. On that note, Mohit urged delegates to consider external partners to help smoothen the journey.