Indonesian institutions in the digital banking and fintech sector are witnessing remarkable expansion. This mushrooming complements Indonesia’s national strategy for AI growth. Articulated in a blueprint, it will guide the country’s AI development between 2020 and 2045 in areas like law enforcement, banking and healthcare.

Currently, customers are required to go through a computerised Know Your Customer (KYC) or third-party onboarding. To further simplify online banking operations and cope with demand, financial institutions will prioritise resources to focus on consumer and digital platforms. This paves the way for advancements in AI platforms such as Graph Database technology.

Without a doubt, Graph Database technology will be at the forefront of battling and preventing escalating online fraud, as well as minimising reputational risk and managing financial risk for financial institutions. By deploying graph database capabilities, institutions can prevent and detect financial wrongdoing such as money laundering and counter-terrorism financing.

With the simplicity of learning and the ability to improve decision-making and fraud detection processes in finance operations, Graph Database technology has become A preferred solution with financial institutions. It is particularly effective in detecting and eliminating financial fraud as it can detect fraudulent practices in real-time and allow for transaction tracking and quick human proofing. As a result, mismanagement and misappropriation of funds can be considerably reduced.

The use of Graph Database will be the most effective way to increase compliance and provide a sense of security whereby risk will be effectively mitigated, and any underwriting or loss of reputation can be avoided.

The focus of OpenGovLive! Virtual Breakfast Insight on 11 November 2021 centred on how Graph Database technology can help to deliver an effective method to detail evidence and inform practical decision-making. The is a closed-door, invitation-only, interactive session with delegates from the banking and finance industry.

Harnessing the power of Graph Database technology for critical analytics

Mohit Sagar, Group Managing Director and Editor-in-Chief, OpenGov Asia, kicked off the session with his opening address.

Mohit emphasised that culture has changed fundamentally. 2021 has proven that a remote workforce is possible. The implication of that, he highlighted, is that businesses, banks and governments will need to get on the same wavelength to retain the workforce.

Being able to evolve and keep up with the needs of the time is critical, Mohit asserts. The speed at which transactions are made and settled have evolved over time. While it used to take three days to settle bonds, in some places it is now one day. He makes a point that Graph Database technology is the technology that can accelerate and value-add to what institutions are doing and provide deeper insights that current models do not offer.

Graph Database technology is not new but a mature technology, which means that it can empower teams with the capacity to detect and interpret data faster than their existing tools. It is not a replacement but an add on; “it is the turbo that you need” to get to somewhere faster, Mohit remarked. Graph Database can perform deep, complex queries, maximise value from existing resources, deliver immediate answers at scale and meet security demands.

Fraud is massive and being able to detect that is important, Mohit asserts. As a tool, Graph Database brings tremendous value in criminal investigations through connected data.

With all this power and potential, the question is: Are financial institutions truly tapping the capabilities of Graph Database technology to detect and interpret data to expand the business and understand clients?

Combined with Artificial Intelligence and Machine Learning, Graph Database technology can smoothen data processing and provide a method for mastering the power of graph relationships and deep analytics for speedy decision-making and accurate forecasting.

Mohit is quick to emphasise that the adoption of new technology happens gradually, not “lift-and-shift”. Organisations will need to explore the infrastructure needed to utilise this technology, set up new infrastructure or integrate with the current infrastructure.

Ultimately, Graph Database technology can tackle money laundering and terrorist financing through better visibility, fast screening and real-time information that can inform decision-making.

Mohit exhorts the delegates to consider partnerships with experts who can guide them in the process of deploying Graph Database. Working with people who know what they are doing is an obvious strategy for making a “good” business “greater” with ease.

Applying Graph Database to AI analytics and data science in financial institutions

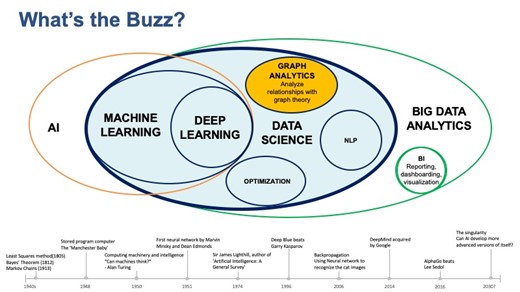

Johnson Poh, Head Artificial Intelligence and Data Science, UOB Singapore, spoke next on the fundamental concepts of analytics and graph, as well as how institutions can enhance the business world and improve operational efficiency.

Breaking down the various concepts related to analytics and graph, Johnson sets Graph Database technology at the intersection of Data Science and Big Data Analytics but nuanced the relationship it has with AI and Machine Learning.

For instance, the output from Graph Database technology can be channelled as input for machine learning and AI. Specifically, Graph Analytics is the science of analysing and representing relationships among entities of interest by way of vertices and interests. Therefore, Graph Database technology can analyse relationships with graph theory.

Johnson makes a case for Graph Database’s greater versatility and effectiveness due to the relevance of interactive and dynamic visualisations over the traditional tabular data formats. Tabular data formats are cumbersome for data analytics while graph technology is highly interactive.

As a visual representation of data, it allows people to make connections that can inform decisions. When the potential of Graph Database is fully harnessed, it can help elevate the business.

According to studies, graph analytics can generate revenue on annual basis and enhance efficiency. Mckinsey estimates that big data analytics can create between $4 to $6 trillion in value annually, while Accenture reveals that banks can expect potential savings between 20% to 25% using big data analytics.

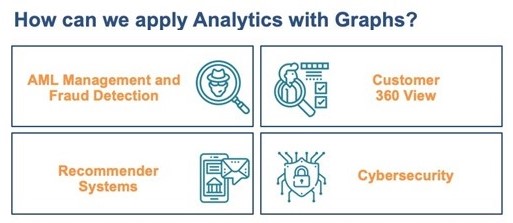

Johnson provided examples of how analytics can be applied with Graph Database technology within the banking and financial industry – AML management and fraud detection, recommender systems, customer 360 view and cybersecurity.

On AML management and fraud detection, he shared that Graph Database analytics allow banks to sift out the underlying transactions and the relationships of fraudulent entities by mapping accounts and fund flows. By leveraging Graph analytics, the human task of investigating fraudulent transactions can be streamlined by prioritising the transactions that matter.

On AML management and fraud detection, he shared that Graph Database analytics allow banks to sift out the underlying transactions and the relationships of fraudulent entities by mapping accounts and fund flows. By leveraging Graph analytics, the human task of investigating fraudulent transactions can be streamlined by prioritising the transactions that matter.

Another application of Graph Databases includes recommender systems. Graph analytics can empower sales teams and analysts to have a unified view of customers and their journey map. With a fuller view of the customer journey, financial institutions can offer personalised and targeted services by analysing the preferences and profiles of customers. By offering a customer 360 view, the technology allows institutions to leverage linkages and relationships and to make connections that can inform operational decisions.

In terms of cybersecurity, Johnson shared that large corporate organisations face challenges in detecting real-time activity and transactions seamlessly. As data increases and operations scale, Graph analytics offers a solution in sifting out critical data.

He concluded his presentation with the assurance that Graph Database technology can greatly benefit the operations of financial institutions, earning the trust of clients, generating revenues and saving on costs.

Staying ahead of the game in a big data environment

The next speaker, Reza Pahlevi, Managing Director-Indonesia TigerGraph, spoke on the use of Graph Database as a tool that can help banking and financial institutions improve operations.

The move towards Graph Database technology is the key to elevating businesses through analytics, Reza believes. By 2025, graph technologies will be used in 80% of data and analytics innovations, up from 10% in 2021, facilitating rapid decision making across the enterprise.

Founded in 2012 and headquartered in California, TigerGraph provides graph database and graph analytics software. In a short span of time TigerGraph has made headway into the financial and government sectors in the Asia Pacific and Indonesia.

Currently, 8 of the top 10 global financial institutions use TigerGraph, he claims. These banks have robust infrastructure and technology to compete in the big data environment, and yet moving to Graph was deemed necessary to improve their operations.

TigerGraph offers a whole gamut of solutions to improve operations at multiple levels – from supply chain management, fraud detection and prevention, to cybersecurity. Increasingly, Graph Database technology is becoming a common tool to solve financial crimes. As an example, within the first year of using TigerGraph, the 2nd largest global bank had savings of US$50 million from early fraud detention.

Handing the time over to Ghulam, Director, Solution Engineering, TigerGraph, the presentation transited to an in-depth look at case examples of how TigerGraph was utilised to detect fraud rings, combat crimes, improve outcomes of healthcare and uncovered tax avoidance and evasions.

TigerGraph was able to help a leading U.S. bank detect fraud and address the issue more swiftly than earlier. The bank was unable to see connected data in context and wanted a better way to detect and remove fraudsters from their credit-card network. With TigerGraph, they were able to expose fraud rings, shut down connected cards and combat fraudulent activity on a massive scale. From a single transaction, the technology can identify the fraud community and identify the main actor and provide a location.

Graph Database technology can also be used in the sphere of healthcare. At United Health Group, TigerGraph combined multiple data sets from various sources of data to create a 360 view of the connections and enabled the organisation to see the user journey in one view. TigerGraph has also been deployed by Gojek, a ride-sharing service, to detect fraud and cheating attempts by drivers and consumers.

Ultimately, he concludes that Graph Database offers the visibility and speed necessary for quicker response time in detecting fraudulent activities, understanding customers and scaling operations. TigerGraph offers a flexible and scalable platform to implement complex logic. It is a necessary solution for financial institutions eager to gain a winning edge.

Interactive Discussions

After the informative presentations, delegates participated in interactive discussions facilitated by polling questions. This activity is designed to provide live-audience interaction, promote engagement, hear real-life experiences, and facilitate discussions that impart professional learning and development for participants.

When asked about whether delegates obtain real-time information with accurate data and information on their current AI or Machine Learning platform, an overwhelming majority (70%) indicated that their current information is not real-time but does offer accurate data and information. Others indicated that their current information is not real-time and are unsure if the data and information are accurate (24%).

For Johnson, the implementation of this solution will require shifts in technology, people and processes.

Mohit agrees that it is not a destination but a journey that progresses incrementally.

The second question inquired about the challenges delegates face in analysing financial information for critical decision-making during the pandemic. The results indicated an even split between screening for the right data or information (40%) and forecasting the accuracy of the decision made in the long run (40%). The remaining delegates opted for drawing a conclusion for decision making to manage risk (13%) and interpreting finance data or information accurately (7%).

Mohit observed that delegates seem to be experiencing challenges with the data and the accuracy of our prediction. It is, therefore, timely to bring in a technology that can provide visibility at rapid speed. In addition, accuracy is becoming more critical in times of the pandemic.

Johnson is convinced that the key lies in making use of real-time data pipelines to support the insight-generation process. Reza explained that the change in behaviour initiated by the pandemic means that there is a need for more accurate data. In that regard, “AI and machine are inevitable.”

On how delegates felt their organisation stood in terms of the speed to screen and detect any unethical actions (Financial Fraud, Money Laundering, Terrorism Financing), the majority of the delegates confirmed that their organisation has moderate speed in screening and detecting unethical actions (71%). The remaining expressed that they do not have a tool or solution to screen and detect unethical actions (29%).

For TigerGraph’s customers, the value-add of the technology lies in speed, accuracy and scalability, Reza elaborated.

Johnson is of the view, where it concerns governance risk and compliance, institutions must always strive for the best practices by leveraging on the tools available. He observes that utilising cutting-edge technology in the next couple of years will become a necessity.

“You can be ahead of the curve or play catch up,” says Mohit.

When asked, most of the delegates (59%) indicated that indicated they are not familiar with the advantages of Graph Databases and how it will enhance their daily decision-making process. The others were split between being familiar but currently not using the technology (29%) and being familiar and currently using the technology (12%).

In response to the results, Reza clarifies that Graph Database technology is an easy-to-deploy option and that it is important to take baby steps towards more strengthening the infrastructure.

Johnson concurred with Reza. While it might seem difficult to implement Graph Database technology at scale and ensure that it is well governed, he believes that institutions can harness the expertise of platforms like TigerGraph to manage the end-to-end flow of work processes and implement real-time pipelines to enrich the insights generated.

Government institutions seem to be ahead of the banking sector in the understanding of Graph Database technology. According to a poll from a previous OpenGovLive! session held for top Indonesian government institutions, 43% of the delegates indicated that they are familiar but have not implemented this technology. This points to a government that is taking the lead in exploring new technologies.

The final poll inquired about the current focus of delegates in utilising a Graph Database platform on their daily and future decision making. Most delegates indicated that their focus was on making the right decision to mitigate risk (35%). Votes were split between detecting and mitigating financial fraudulent related activities (29%) and other focuses (29%).

For Mohit, all the options are equally important. If institutions want to cover every use case, they will need a well-structured platform and process that will help to scale up the implementation in a seamless fashion.

Conclusion

Wrapping up the session, Reza emphasised that adopting Graph Database technology can be a gradual process. It is an add-on feature that is versatile and easy to deploy. As the challenges in a rapidly changing world grow, Graph Database technology will be the key to a competitive edge. It can help institutions stay ahead of the game and accelerate businesses in achieving their business objectives.

Before bringing the session to an end, Reza thanked thank everyone for their participation and honest sharing. He encouraged the delegates to continue to learn and understand Graph Database technology, exchange ideas and connect with him if they have any queries.