Financial institutions can incur losses in a variety of ways and these risks are becoming more complex as technology advances. With the growth of the digital enterprise, banks face challenges in maintaining data quality and security, as well as making data-driven decisions, because they deal with a vast amount of partially structured and unstructured data points.

Almost all risk management strategies are based on awareness and transparency. While data collection and analytics tools are now widely available, organisations still struggle to integrate several sources of data and outdated infrastructure to determine the best course of action.

To ease their digital transition, banks should shift from manual to automated, information-driven, real-time systems with the right partners and technologies. However, banks must have system design and controls in place to address the numerous operational and security risks associated with digital banking.

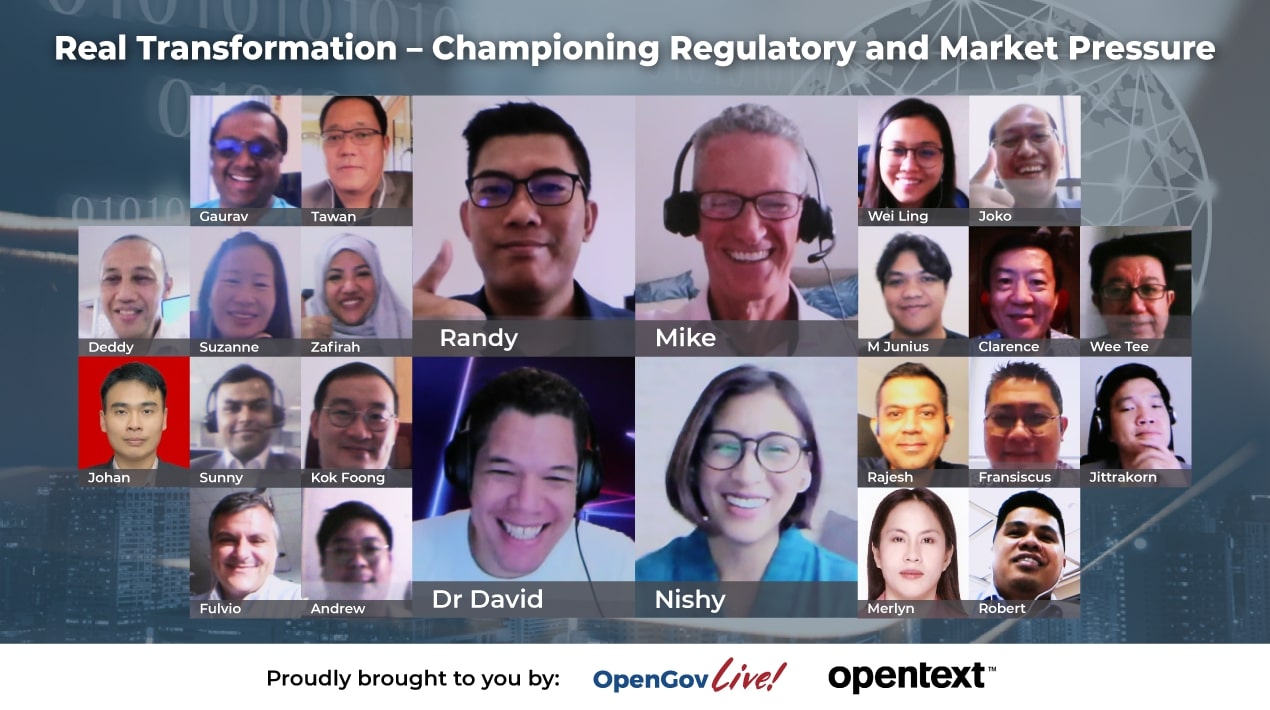

The OpenGovLive! Virtual Breakfast Insight held on 09 June 2022 focused on how to thrive in the digital banking environment to maintain its competitiveness and security and offer the best customer experience possible.

Robust Security Strategies

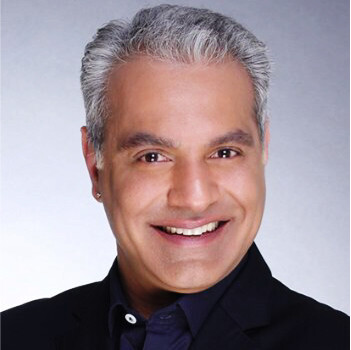

Mohit Sagar, Group Managing Director and Editor-in-Chief, OpenGov Asia believes that business security breaches are making headlines emphasising data fragility and the absence of effective security policies in organisations of all sizes.

Data security is vital in both private and government sectors, and everything from financial data to employee information must be safeguarded. One’s reputation and finances could be harmed if one’s security is breached.

“As the pandemic spread around the world over the past years, most organisations have made it a top priority to manage their operations or services remotely. A lot of employees and employers have to adjust to the new normal of working from home,” observes Mohit. “As more individuals go cashless and more digital options are offered, activities and transactions are increasingly taking place online.”

With the rise of digitalisation, cybersecurity threats have also increased substantially. The fundamental goal of cybersecurity in digital banking is to protect the interests of its customers, their staff and their reputation.

Mohit opines that digital banking security must become far more robust and comprehensive because the banking industry has become increasingly susceptible to cyber strikes with the wider attack surface online transactions provide.

He acknowledged that an increasingly complicated digital workplace demands leaders who can foster an agile attitude to achieve long-term success. With the assistance of the right partnerships, banks and other financial institutions may be able to achieve flawless cybersecurity that does not expose their clients’ data and funds.

Mastering Digital Agility

Mike Hooper, Director, Digital Transformation (APAC), OpenText spoke on how to empower people and processes with a holistic approach to technology. He explained that people and processes will be more effective if they are provided with the information they require.

“A successful transformation should focus on establishing digital agility,” Mike states. “The ability to foresee and respond to rapidly changing situations is at the forefront of most business leaders’ minds considering tremendous technological advances and an increasingly disruptive operating environment.”

What is important for banks is satisfying their customers’ needs by ensuring a uniform banking experience regardless of platform or channel. In the future, financial institutions will need to determine the role of each entity.

Financial institutions must manage digital risk, enhance customer experience, transform their businesses to become future-ready and create a more resilient financial services ecosystem. They may have to rethink business models and alter customer relationships using digital technology and procedures.

Compliance with digital banking services must be prioritised to ensure that banks and other financial institutions can detect any fraudulent actions and continue to provide their services.

Banks and other financial institutions have made substantial investments in their services and products, and they must stay as close as possible to the emerging and latent demands of their clients. Even governments need to ensure the security of their digital transactions by taking a comprehensive picture of clients and services.

Both the private and public sectors can use metadata to better comprehend documents, and its archiving is the key to accessing the information. A partnership is the best solution for privacy protection.

Through Core for Federated Compliance, which provides cross-repository visibility and policy control for transparency and defensibility of organisational information governance processes and reporting, OpenText can assist any organisation in scaling up their current system without compromising the old one.

Digital Dialogue: Experts on Regulations Strategies in Digital Banking

In the next session Mohit engaged in an in-depth conversation with Nishy Ramos, First Vice President, IT Solutions Delivery, BDO Unibank and Dr David R. Hardoon, Chief Data and AI Officer, Union Bank of the Philippines.

Digital banking specialists have been brought in to examine how technology may help reduce the danger and cost of uncontrolled data while maintaining regulatory compliance.

Mohit invited the guests to share their opinions on the outlook of digital transformation from their perspective. The discussion centred around regulation plans, from a strategic standpoint, as well as the use of tools or technology by IT specialists from the banking sector.

According to Nishy Ramos, First Vice President, IT Solutions Delivery, BDO Unibank, it is critical to perform proactive interactions and understand where the organisation is heading and collaborate closely with an internal team.

She believes that understanding the customers’ demands digitally and employing technology is important for a bank, government or any industry, “We study our customer’s profile this helps us to understand their needs.”

The main issue that most firms face is that risk managers do not always understand data, and data managers do not always understand risk. These companies are giving their employees access to a more holistic approach to data management through data or knowledge portals. Instead of wasting time trying to make sense of vast amounts of disparate data, users can gain more accurate and timely insights.

Furthermore, as the world remains in the grips of the pandemic, the significance of holistic digital services in banking becomes clearer, which has further strengthened the case for why conversational banking is the game-changer in digital consumer engagement.

“Every organisation takes a different approach, but the most important is centralisation. It is the ability to comprehend your clients.” According to Dr David R. Hardoon, Chief Data and AI Officer, Union Bank of the Philippines. “Sharing is caring! Leveraging the skills from other experiences will strengthen the industry and can boost the digital economy.”

Banks and other financial institutions must continuously assess and manage cyber risks by monitoring their organisational information systems and operational environments. This will help to verify compliance, determine the effectiveness of risk response measures, and identify risk-impacting changes.

In addition to being compliant and supervised by regulatory agencies, data “centralisation is the key”, creating metadata that may benefit organisations in constructing an ecosystem.

Moreover, transparency both internally and publicly must be improved by clearly defined firm spending standards, which include pre-set thresholds for teams and individual employees. It also demands trust and accountability, as well as empowering people to take control of how they spend for the organisation.

Technology centralisation must be implemented and to improve security and cost, the banking industry must test cloud-based services and deploy testing tools. Big data analytics is used by banks to create customer-centric and customer-driven solutions. Because big data is synonymous with massive amounts of data, ensuring the app’s scalability and security is crucial.

Interactive Discussion

Following the informative presentations, delegates engaged in interactive dialogues aided by polling questions. Through live audience interaction, participation, and the sharing of real-life experiences, this is intended to provide participants with professional learning and growth.

Delegates had the opportunity to learn from subject matter experts, exchange their experiences and bring back methods to their organisations.

The first poll asked the delegates what their top priority is when choosing the right technology. A majority (47%) went with providing the ability to consolidate information sources and reduce architecture complexity and costs. Just over a quarter (28%) indicated they adopt technology that supports business data – creation, management, delivery and analysis processes (28%) while a fourth (25%) support the creation of a holistic view of Information (Structured, Unstructured and Paper) across the organisation.

The first poll asked the delegates what their top priority is when choosing the right technology. A majority (47%) went with providing the ability to consolidate information sources and reduce architecture complexity and costs. Just over a quarter (28%) indicated they adopt technology that supports business data – creation, management, delivery and analysis processes (28%) while a fourth (25%) support the creation of a holistic view of Information (Structured, Unstructured and Paper) across the organisation.

Clarence Goh, Senior Vice President, Head of Process Development & Data Management, HSBC Singapore said that it is a holistically view if they combine with the appropriate partners and serve their clients better. He also believes in the centralisation of digital space. Tawan Jitavech, Chief, Technology Officer, Kasikornbank concurred with this perspective.

Kok Foong Lee, Senior Vice President, Technology and Operations, DBS Bank said various organisations have different needs and agreed on the importance of centralising digital space. Gaurav Gupta, Senior Vice President, Head of IT Audit Management and IT Regulatory Management, United Overseas Bank said digitisation improves the economy.

Fransiscus Kaurrany, Executive, Chief Architect Officer, Bank Central Asia agreed that it is all about priority and execution and making sure that the technology they are using is appropriate for their organisations. He cited that people is the most important to them because they are the one who will choose the technology.

On what their IT department’s most important priority is, about 42% said that building more resilient infrastructure and enabling enterprise-wide business capability was a priority. Over a quarter (28%) chose to better innovation and agility through digital maturity while 14% went with digital record-keeping to better support government legislation and improve and reduce maintenance costs.

For Joko Christianto, Head of IT Strategic Planning & Development Division, PT Bank Tabungan Negara documentation is important. Robert Malabao, Section Head, Internal Audit Analytics, BDO Unibank, Inc., believes that technology can hasten the development of a more robust business future.

Andrew Ooi, Head of Disaster Risk Recovery, CIMB Bank Singapore shared that innovation is the key to being successful in their industry. Wei Ling Tan, Senior Data Scientist, Maybank felt that employees’ experiences are important for her because the people will utilise technology effectively if they have the right skill set.

Johan Suparto, Head of Business Automation System, PT Bank Mega Finance is convinced that infrastructure is most important since customers would leave if they are unsatisfied with the products. Zafirah Muhamad Zulkapley, Head, IT Audit, Bank Rakyat shared that they aim to move forward and find the whole balance in the digital ecosystem.

Merlyn Nuguid Section Head, Information System Audit BDO Unibank, Inc. mentioned that businesses need to be very competitive with the other organisations’ Infrastructure and there is a high demand to scale up to digital maturity.

Looking for the key challenge delegates face when managing change in data/business requirements, over a third (36%) felt that employee skillsets were an issue, The next two issues were a lack of flexibility/agility and data governance framework in current systems (26%) and a reluctance to consider or adopt new technologies (21%). The remaining 15% were concerned about the time involved in making changes.

Jittrakorn Juthakan, Head of Cybersecurity/ Chief Information Security Officer, HSBC Thailand said that data is a major challenge for them, but they are confident in employee skill sets since individuals will work for the company.

Conclusion

The Breakfast Insight concluded with remarks from Randy Goh, Regional Vice President, Southeast Asia OpenText, who believes that the lack of communication and shared understanding between data and risk teams is a big barrier in many organisations.

The Breakfast Insight concluded with remarks from Randy Goh, Regional Vice President, Southeast Asia OpenText, who believes that the lack of communication and shared understanding between data and risk teams is a big barrier in many organisations.

The first step in modifying the role of risk functions in a modern organisation is to encourage teamwork and shared work practices. In digital transformation, people and procedures are the most important aspects. This would result in a massive opportunity to create long-term financial value for private companies and government agencies.

Although technology may significantly alter how an organisation operates, digitalisation cannot reach its full potential without a strong emphasis on change management.

Placing the right individuals in the proper roles is critical to an organisation’s success. They are the ones who make a company operate, thus it’s best to always value their talents and be assisted in learning how to use new technologies by their respective organisations.

Furthermore, numerous procedures are automated to improve the efficacy and precision of digital banking, enabling financial institutions to optimise their services and business models through digitisation and new technologies. To optimise and expedite payment processes, the financial services sector is under pressure to comply with new regulations and security concerns.

“Consider what technology fits your organisation and would not only deliver but also manage your needs,” Randy said.

He concluded his remarks by thanking the delegates and offering the support of his organisation, encouraging delegates to reach out to him and his team to explore further steps.