The HKU FinTech Index Series Project published the third-year Hong Kong FinTech Growth Index (FGI) and the 2021Q1 Hong Kong FinTech Buzz Index (FBI) to gauge local FinTech companies’ outlook and the general sentiment on the sector as reported by the local press.

Hong Kong FinTech Growth Index – 2021

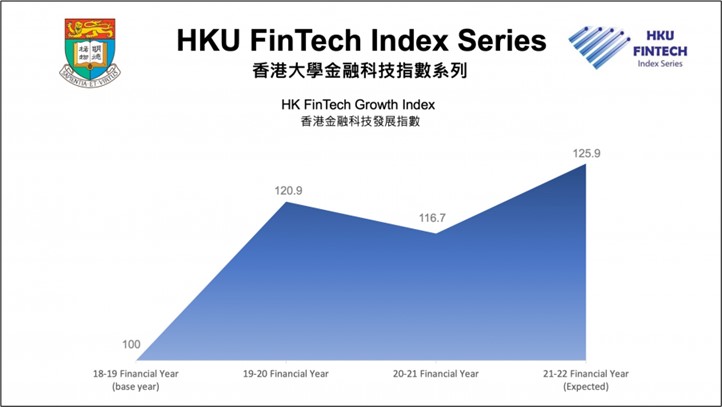

The Hong Kong FGI represents responses to an annual survey by 45 companies, 18 more than 2019-20. The FGI for the financial year 2020-21 is 116.7, which has decreased by 4.2 index points (or 3.5%) since 2019-20. This may be attributed to the continued uncertainties arising from COVID-19 and the evolving political environment. The FGI expected for the financial year 2021-22 is 125.9, a rise of 9.2 index points (or 7.9%) from the current year, and a three-year high from 120.9 in 2019-20.

Among the four sub-indices, the Business Environment sub-index, measured by both internal and external factors on FinTech business operations and development, has seen the largest decline (14.6%) from the previous year. According to the survey, the respondents perceived that a “Safe and stable investment environment” and “External funding opportunities” posed increased challenges to FinTech businesses during this period.

Similarly, the Investment in R&D or Product Development sub-index has decreased by 9.9 index points (or 7.8%) compared to the previous year, possibly due to continued uncertainties arising from COVID-19. It is expected that the sub-index will increase by 5.4 index points (or 4.6%) in the following year, fluctuating between 115 and 125 index points.

The Demand for Talents sub-index has largely remained unchanged since the previous year and is anticipated to stay almost constant and high in the coming year. The survey results revealed that FinTech companies are mostly looking for mid-level job candidates (73.3%), followed by intermediate level candidates (71.1%).

On the other hand, the Business Performance sub-index, measured by FinTech customer adoption rate and revenue, has risen by 6.1% since the previous year. It also has the highest expected growth rate (16.1%) out of the four sub-indices.

This indicates that current FinTech businesses are optimistic with regards to their performance, which might be due to the belief that the Hong Kong economy will soon recover from the COVID-19 pandemic. The fact that COVID-19 has motivated the development of technology solutions could also have led to such an uptrend.

According to the survey, WealthTech, E-payment and digital banking, as well as Blockchain and Cryptocurrency sectors have the largest contribution to the increase of this sub-index.

Hong Kong FinTech Buzz Index – 2021Q1

Having analysed 1,288 news articles posted between January and March 2021, the Hong Kong FBI for the first quarter (Q1) of 2021 is computed to be 101.7, showing a moderate decline of 1.9 index points (or 1.83%) in the fourth quarter of 2020 (2020 Q4).

Performance differed across the six sectors, with a rise recorded in the sectoral indices of InsurTech, RegTech & Cybersecurity, and Supporters & Others. The rise in the InsurTech sectoral index can be attributed to the event of ZA Bank being granted an insurance agency licence by the Insurance Authority, to acts as an agent of ZA Insure.

The fact that HKSTP has been rolling out its Banking Virtual Lab with Hang Seng and HKMA’s plan in enhancing its FinTech Supervisory Sandbox led the RegTech sectoral index to reach its historical high. Financial development in the Greater Bay Area also contributed to the increase in the index for the Supporters & Others sector. On the other hand, the decrease in the Blockchain & Cryptocurrency sectoral index was mainly due to the concerns with regards to regulation on cryptocurrency.

About the HKU FinTech Index Series Project

The HKU FinTech Index Series Project introduces the Hong Kong FinTech Growth Index (FGI) and the Hong Kong FinTech Buzz Index (FBI) to gauge local FinTech companies’ outlook on the industry and the general sentiment on the sector as reported by the local press.

It is the first in the region to provide index indicators on the development of the sector, with an aim to provide information promptly to track the growth and development of the financial technology industry in Hong Kong.