Hong Kong is on its way to becoming a leading location for digital innovation, according to a recent report. The region boasts of access to a diverse pool of talent, a strategic location within the Greater Bay Area and an open Internet infrastructure.

However, despite the clear advantages, a recent report noted that only 34 per cent of Hong Kong businesses maintained a web presence and only 8 per cent received online orders.

While the HKSAR government has proactively encouraged digitisation, a collective effort is necessary to establish Hong Kong as a front-runner among smart cities.

The report noted that the government’s smart city plans for Hong Kong are highly commendable, but the efforts made thus far are still a ‘work in progress’ and have yet to be fully recognized by consumers and much of the business community.

The residents of Hong Kong residents awarded their city a ‘middle-of-the-pack’ status in terms of it being a “smart city.

However, the corporate sector of the city views it more conservatively, ranking the city as least smart among six regional neighbours. This sector is actively seeking to participate and avail itself of the commercial opportunities that digitisation presents—benefitting both their businesses and the city.

In a positive development, 67 per cent (compared to 48 per cent in 2017) of respondents were enthusiastically researching current digital technologies relevant to their sphere. Furthermore, 73 per cent of the corporate sector now expects fast and even rapid embrace of technology in their organisations.

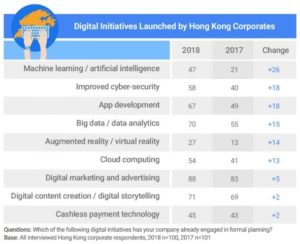

In fact, this year, 85 per cent of corporates have increased their digital investment, and 90 per cent foresee investing even more in the coming two years. The areas that have seen stellar improvements include machine learning and artificial intelligence, improved cybersecurity and app development.

SMBs need to embrace digitisation

In order to turn Hong Kong in a truly Smart City, small- and medium-sized businesses (SMBs) must keenly embrace digitisation to bolster growth.

And, while its benefits are obvious, only 50 per cent of SMBs agree that digitisation will be a key aspect of their future.

Currently, the digitisation for Hong Kong’s SMBs has been primarily focused on systems automation, as it enables cost reductions and increased profitability.

SMBs in the Chinese industrial cities of Shenzhen and Guangzhou are also witnessing the effects of digital disruption, and a growing majority now accepts digital adoption as being fundamental to their business expansion goals.

Respondents from these cities prioritise investing in cashless payment technology and using big data, with a keen focus on enhancing customer experiences and customer acquisition.

Digitising Travel more rapidly

In Hong Kong, digitising travel has registered the most progress, witnessing an increase in digital engagement by 11 points year-on-year – a shift driven primarily by smartphones. In fact, 98 per cent of consumers search for information online prior to travelling, and 66 per cent do so on a smartphone.

Users are able to check in for flights, manage loyalty programs and navigate during trips.

The report highlights that of the more than 70 initiatives included in the Hong Kong government’s Smarter City Blueprint, smarter heavily featured travel.

In the case of air travel, shorter waiting times and seamless travel experience are top priorities for both business and leisure segments. The Hong Kong International Airport, too, has adopted several measures in this regard, such as smart luggage tagging and facial biometrics.

As a result, there are fewer queues and faster check-ins. Moreover, augmented reality in a mobile app will also soon help travellers find their way with greater efficiency.

Digitisation in Personal Banking

Hong Kong’s personal banking sector has made significant strides toward encouraging users to adopt digitisation.

Currently, 57 per cent of Hong Kong residents have used a smartphone to make a payment and 44 per cent reported making a peer-to-peer money transfer using a smartphone – an increase of 11 per cent year-on-year.

One bank’s e-payment app is boasts of a user base of one million customers. In addition to providing convenience, apps like these enable financial institutions to collate valuable data that can be used to gauge user preferences and trends. In effect, it will enable such organizations to better serve their customers.

Although users have responded positively to online engagement, a large chunk is still in favour of offline options on account of the availability of customized products and services, including better after-sales service. When considering financial products, consumers tend to pose more questions and demand follow-up support. In this regard, in-person consultation (49 per cent) and having a contact to follow up with (53 per cent) were highlighted as key advantages of offline application—especially when customers were applying for complex financial products like mortgages and insurance.

Digitisation in Retail

Online shopping is considered a convenient channel, allowing for an efficient experience with easy delivery and price comparisons.

In Hong Kong’s case, online to offline (O2O) commerce is of particular importance, considering its potential to leverage the city’s retail density, traditional consumer preferences, and leading smartphone penetration.

Interestingly, Hong Kong residents displayed a tendency to make purchases via an app or website but chose to collect their items in-store.

Consequently, “click and collect” represents a crucial element in the O2O ecosystem, with in-store pick-up volumes exceeding delivery volumes. However, Hong Kong’s e-commerce sector is associated with poor product variety that reflects a growing expectation that consumers should be able to get everything they need in one go, the report stated.

The Future

Astonishingly, the demographic that registered the highest digital engagement level constitutes a major chunk of Hong Kong’s population – residents aged between 55 and 64 and is an encouraging trend that illustrates how the impact of digitisation on quality of life often generates positive momentum.

It is important to note, however, that guaranteeing the long-term competitive advantage of Hong Kong necessitates the contribution of multiple stakeholders, including the corporate sector, SMBs and members other, younger members of the public.