Yesterday we reported that President Duterte had approved the (National Broadband Plan NBP) for the Philippines. Now the Department of Information and Communications Technology (DICT) has shared the working draft of the NBP Plan on its website, and is inviting inputs and comments until 24th March 2017.

Four outcomes form the plan’s vision: Accelerated investment, Mobilized and Engaged Public and Private Sectors, More Places Connected and Increased take-up rate.

We summarise below how that vision is expected to be realised. Several initiatives revolve around laws, policies and regulations, either in terms of issuing new ones or harmonising old ones and eliminating those that are redundant. The other area of focus appears to be on establishing frameworks for private telecom companies to work with the government agencies and with each other and for all existing assets, whether government or private.

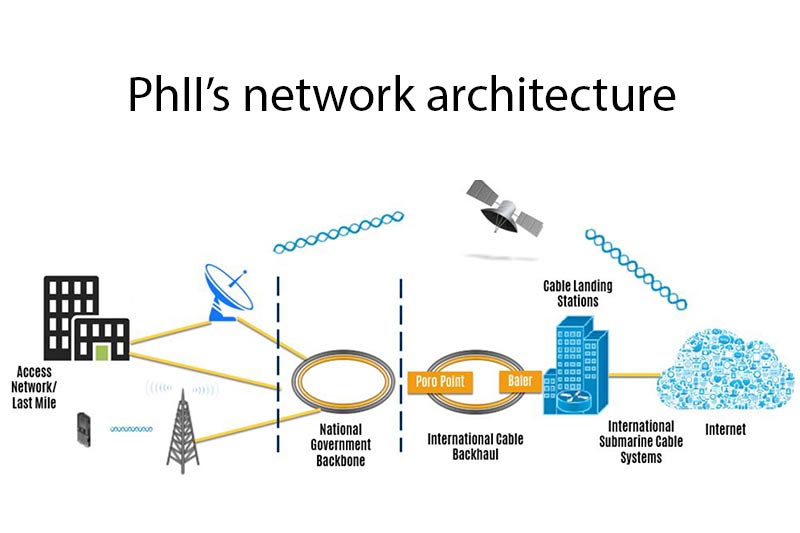

One of the most important initiatives mentioned in the draft is the Philippine Integrated Infostructure (PhII), which is supposed to form the core of the broadband infrastructure, leveraging existing assets from across government and acting as an aggregation network. PhII is expected to provide at least 10 Mbps to households by 2020 at lower cost.

Accelerated Investment

In order to accelerate investment, particularly in the unserved and underserved areas, the government will take a number of steps:

- Review and Develop Laws, Policies and Regulatory Issuance: Laws, Policies and Regulatory Issuances that govern telecommunications/ICT will be amended with a view to making them more responsive to responsive to technology advancements and market needs and tackling issues on convergence, competition and institutional arrangements.The government will also develop a framework segmenting the existing market structure into three parts: (1) content/applications provider, (2) network provider, and (3) service provide in order to ensure the competition in the telecom/ICT market. a peering framework shall be established to mandate existing players to connect with other networks. Standards will be adopted standards for fiber deployment in residential and commercial areas.

- Harmonise Broadband-related Permits, Fees and Processes: In order to facilitate faster roll-out, local government units may streamline permits and processes by establishing a one stop shop offline and online facilities. The national

government may also consider the review of the existing permits (the draft lists around 15 permits at national level from 7 agencies) and licenses, to eliminate unnecessary and redundant requirements.

- Ensure Protection of Critical Infostructure Assets: The draft recommends the inclusion of the protection of telecommunications/ICT infrastructure in the National Cybersecurity Plan. Plans will be prepared for Incident Response, Business Continuity

and Disaster Recovery.

- Incentivise Market Players Investing on the Unserved Areas: The draft talks about a Joint Memorandum Circular with the Department of Finance (DOF) and the Department of Trade and Industry (DTI) for tax reduction and subsidising projects and investments in the country. DTI along with the Philippine Competition Commission can look into the industry of bandwidth reselling.

Mobilized and Engaged Public and Private Sector

The government will establish strategic partnerships with private sector/industry players, civil society organizations and academia and facilitate their participation through the right mechanisms to deliver more inclusive telecommunications/ICT services.

- Establishment of Universal Access Fund: The draft recommends the establishment of an Universal Access Fund (UAF) along with the policies for governing and managing it. The UAF can be utilised to develop shared community networks in the countryside.

- Facilitate Infrastructure Sharing: The government will provide guidelines in infrastructure sharing, covering systems interconnection and integration models and standards, interconnection fee structure, dispute resolution, repository of available infrastructure and infrastructure sharing regime.

- Leverage Existing Government Infrastructure Assets: Existing government – owned facilities will be opened up to market players. For instance, DICT (former Telecommunications Office or TELOF) towers available through PPP, MOA or lease agreement. Or companies could liaise with the Department of Transport to allow fiber roll-out along the existing railroads and access roads to airports and seaports.

- Institutionalize “Dig Once” Policy: The government shall institute a dig once policy to minimize road disruptions and enhance cost-efficiencies. The policy will establish a regime that will coordinate utility service providers and government agencies to synchronize the deployment of infrastructures.

- Use the Existing Infrastructure of Utility Companies: The government may consider use of the existing infrastructure facilities like roads, electricity poles, and others to further minimize costs associated with civil work.

More Places Connected

- Optimise Spectrum Utilization: The government will look at repurposing/ recall of assigned but unutilized and underutilized spectrum and adopt dynamic spectrum allocation for the future. Co-use of spectrum will be encouraged by establishing a framework for spectrum sharing, protecting customers’ interests and preventing collusion.

- Leverage the Use of Satellite and Emerging Technologies: The government will consider the deployment of satellite receivers to provide broadband services in reas where other terrestrial and submarine broadband technologies are not feasible. The deployment of TVWS (TV White Space or the unused broadcasting frequencies in the wireless spectrum, which can be used to deliver Broadband Internet) Technologies will be accelerated.

- Establish the PhII: According to the draft, the government will establish the PhII to address bottlenecks particularly in backbone and backhaul segments, affordability issues, as well as to augment the bandwidth. It will consist of international submarine cable landing stations, national government backbone, and the last mile access network.

PhII is expected to provide a demand-responsive core and aggregation network for the national government agencies, local government units, public elementary and secondary schools, state colleges and universities, public hospitals and rural health units. It will also leverage the existing government assets and initiative such GovNet, IGovPhil, Free Wifi in Public Places and TECH4Ed to further lower implementation costs. A mix of wired and wireless broadband technologies, such as White Space and Satellite and others are considered for middle/last mile segment. Three options are being considered for the last mile:

Increased Take-up Rate

As part of the NBP, the government will focus on stimulating demand and increasing the adoption rate. such as (1) promotion of the use and production of local contents and applications; (2) conduct of digital literacy programs; (3) introduction of conditional fiscal incentives to broadband users; (4) development of a rural technology roadmap; (5) setting up standards to monitor quality of service.

Implementation and monitoring

The Office of the President will release an Executive Order to provide appropriate policies and guidelines towards the plan adoption.

The project can be segmented by major island groups, region or network design, so it can be implemented simultaneously throughout the archipelago to fast track implementation. A Project Management Office will provide oversight for the NBP implementation and establish policies and procedures. Feasibility studies will be followed by call for Proposals and Public Bidding.

For tracking implementation progress, targets and indicators will be set, taking into account the whole broadband ecosystem and adopting the existing standard metrics set by International Communication Union, World Economic Forum etc.

Read the working draft of the NBP here.