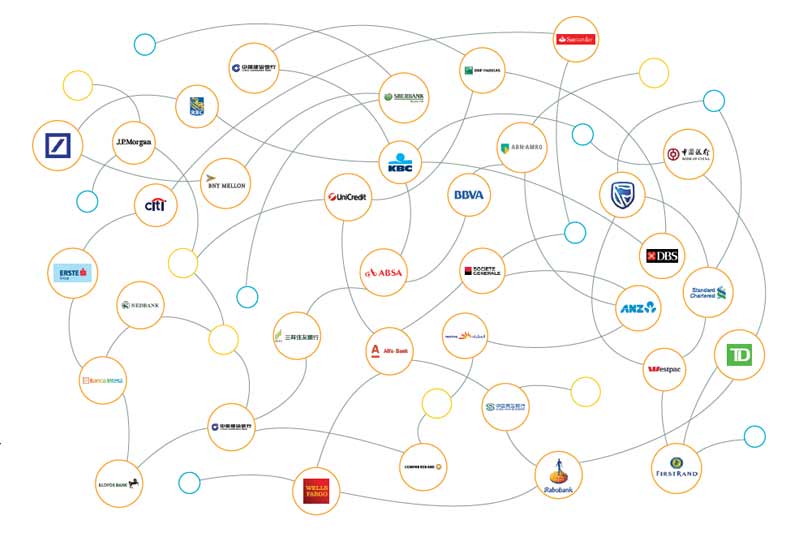

Above image showing participating banks from SWIFT's interim paper on Nostro proof-of-concept

SWIFT ( Society for Worldwide Interbank Financial Telecommunication) has published an interim report on a proof of concept (PoC) for real-time Nostro reconciliation using a SWIFT-developed distributed ledger technology (DLT) sandbox with 33 global transaction banks, as part of its SWIFT gpi service. SWIFT gpi (global payments innovation) is a new standard for cross-border payments, available since January 2017, that combines real-time payments tracking with the certainty of same-day settlement. Since it became available in January 2017, over 110 global transaction banks have come onboard.

SWIFT’s DLT POC started in April 2017. The PoC is testing whether DLT can help banks reconcile Nostro accounts more efficiently and in real-time, while lowering costs and operational risk. The report provides an overview of the PoC to date, including technical objectives, early findings on the potential business benefits, as well as key challenges that still need to be addressed to achieve industry-wide adoption.

Under the current correspondent banking model, a correspondent bank provides services on behalf of another overseas financial institution through a correspondent account (Nostro/ Vostro accounts). Correspondent accounts are established through bilateral agreements between the two banks. Banks need to monitor the funds in their overseas accounts via debit and credit updates and end-of-day statements. The maintenance and operational work involved represents a significant portion of the cost of making cross-border payments.

On average, 34% of the cost of an international transaction is related to Nostro trapped liquidity caused by the absence of real-time data that would better facilitate Nostro supply and demand. Around 9% of the cost is linked to investigations or exceptions, mainly driven by a lack of standardisation in the end-to-end payments process and by the related Nostro account reconciliation.

A real-time information mechanism at transactional level would not only reduce costs by enabling liquidity optimisation; it would also enhance banks’ ability to provide a better service to their customers by enabling earlier release of payments, while reducing recalls and liquidity risks. At the same time, access to the data about a particular Nostro/Vostro account must be granted only to the actual account owner and servicer.

Hyperledger Fabric v1.0 (Hyperledger is a global open source collaborative effort created to advance cross-industry blockchain technologies, hosted by The Linux Foundation) was selected as the underlying technology for the SWIFT DLT sandbox. Preliminary results of the PoC, based on testing of standard use cases by the six banks[1] of the DLT PoC founding group, show that the SWIFT-developed DLT application can deliver the business functionalities and data richness required to support real-time liquidity monitoring and reconciliation. DLT provides real-time visibility to both the account owner and its servicer on the available and forecasted liquidity on the Nostro account and supports payment reconciliation and investigations by providing an enriched data model based on ISO 20022[2].

SWIFT’s DLT sandbox also demonstrated progress in DLT technology and helped identify issues that still need to be addressed to achieve industry-wide adoption. Specific challenges include the need to develop unique value propositions in response to the different levels of sophistication, automation and past investments of banks.

Global transaction banks usually rely on their own internal entities for the settlement of their payments in key currencies representing the largest share of a bank’s liquidity at group level. In most cases these banks have implemented a real-time automated data capture from the different high value payments settlement systems to which they are connected. They have also built transactional databases which are not only leveraged to feed in real-time their internal sophisticated liquidity tools but also to provide services to their different types of customers (both financial institutions and corporates or retail customers). The added value from a real-time DLT solution for these banks would might be limited.

The value of a DLT shared ledger solution is expected to be higher for mid-tier banks that settle a very large share of their payments through various Nostro Account Servicers and have not yet implemented a real-time liquidity monitoring solution for these flows.

In addition, it is crucial that integration with legacy back office applications and co-existence with existing processes is taken into account. The interim report highlights that the integration of DLT technology in the correspondent banking space should avoid disruption and prevent the need for large service providers to subsidise a large part of the industry deployment. In addition, to support industry adoption there will be a need to develop a collaborative service with a common rule book and technical specifications based on agreed standards.

The DLT sandbox demonstrated significant progress of DLT towards maturity, especially with regards to data confidentiality, governance, identification framework and scalability. However, these new solutions have a very different architecture, moving towards a hybrid model where some components are distributed and where others are centralized and operated by a neutral third party. The report notes that the architectural decisions bring significant advantages as they are tailored for the financial industry but their impact also needs to be carefully assessed.

Data resiliency in particular becomes more complex. Since data is physically segregated to ensure data confidentiality, one node can no longer recover from any node. Instead, it will need to rely either on some local resiliency setup within its own institution, on its counterparty’s nodes or on a central service data confidentiality, governance, identification framework and scalability.

SWIFT is currently working with the validation group of 27 financial institutions to complete the testing programme by November 2017 and will release a whitepaper with its final conclusions in December 2017. The paper will provide final conclusions on the viability of DLT as a means to eliminate reconciliation and boost real-time liquidity capability for bank and on pros and cons compared to potential alternatives.

[2] A standard for electronic messaging between financial institutions. A global and open standard, ISO 20022 is not controlled by a single interest: it can be used by anyone in the industry and implemented on any network.