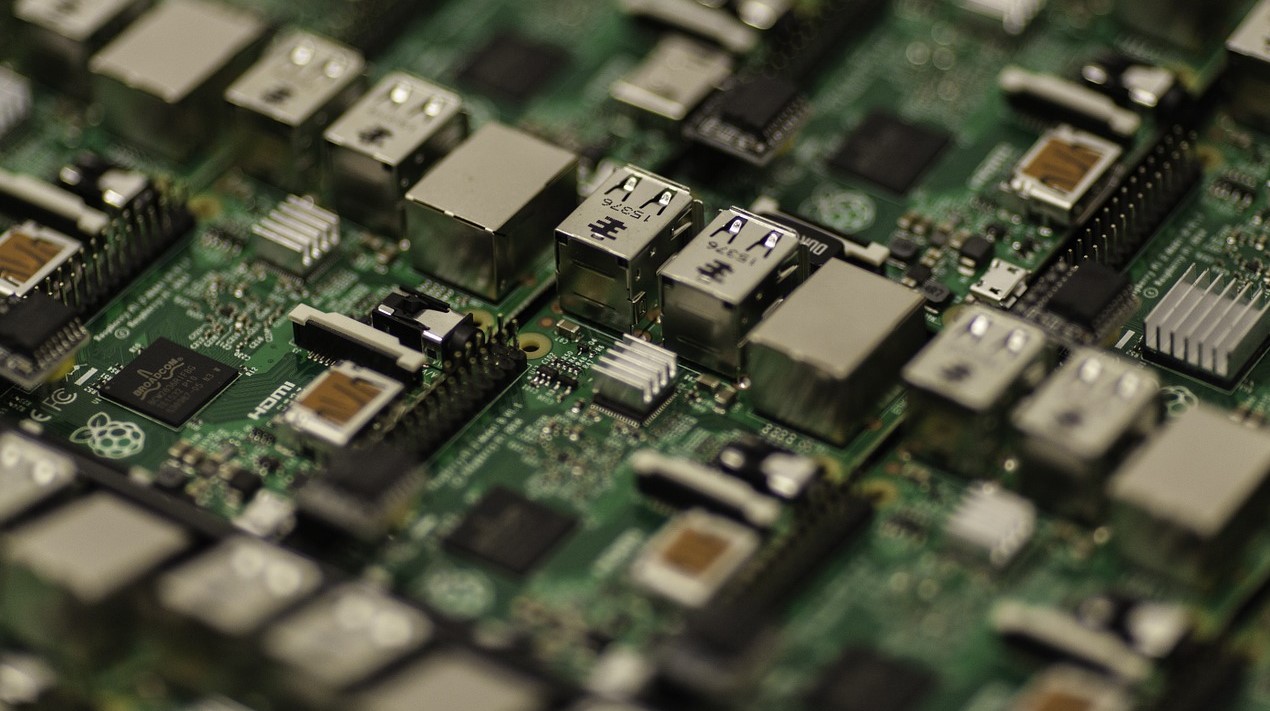

Last year, the Philippine electronics export revenues increased by a record-high 12.9% from the year before, despite the pandemic-related curbs, according to an industry report. In 2021, the country’s semiconductor and electronics sector shipped $45.92 billion worth of goods. The 2020 lockdowns disrupted the industry’s pre-pandemic rise, posing record earnings for three years in a row. In 2020, earnings dropped by around 6% to $40.67 billion. The record revenues in 2021 means electronics now account for more than 60% of the country’s total export receipts of $74.64 billion in 2021.

The report stated that a key driver for the rise in demand is electronic components used in telemedicine, work-from-home arrangements and artificial intelligence (AI), among others. Electronics sectors that posted growth in exports last year were telecommunications (138%), medical or industrial instrumentation (37.49%), electronic data processing (29.51%), consumer electronics (19.45%), office equipment (19.32%), control and instrumentation (12.92%), and components or devices or semiconductors (7.37%).

In December alone, the country’s electronics exports went up slightly to $3.92 billion from $3.90 billion in the same month in 2020. Electronics sectors that saw exports climb in December were telecommunications (183.97%), automotive electronics (39%), office equipment (29.70%), and semiconductors (1.61%). The top destinations for Philippine electronics exports in December last year were Hong Kong, the United States, China, Singapore, and Japan.

The report expects that this year, export revenues could grow by 10%. The projection depends on improvements to inbound and outbound logistics flows, supply chains, the health of the population as well as the reopening of the country. The report also suggests that country could do much more. Most of the electronics manufacturing companies in the country are within the Philippine Economic Zone Authority (PEZA) locations. A key challenge is its ability to attract as many new investments as its peers in Southeast Asia. The industry is asking to amend the Corporate Recovery and Tax Incentives for Enterprises Act (the CREATE Law), which was passed in March 2021.

The CREATE law reduced corporate income tax and rationalised tax incentives and set a threshold for investments that can be approved by investment promotion agencies (IPAs) like PEZA. While the CREATE Act cuts the corporate income tax from 30% to 25%, it requires exporters to surrender their fiscal incentives within ten years. Under the new law, IPAs can only approve a project worth PHP1 billion ($19.6 million) or less. Investments with higher value need to be approved by the Fiscal Incentives Review Board, headed by the Department of Finance.

The Philippine Department of Trade and Industry (DTI) recently announced it is drafting the Philippine Export Development Plan (PEDP) 2022-2027 to improve the country’s competitiveness in international markets. It has an overarching goal of transforming the country from an exporter of commodities and intermediate goods to an exporter of high-value products and services. The new PEDP is envisioned to take an industry development approach to boost export competitiveness; that is, by attracting export-oriented investments in innovation driven-sectors to increase product and service diversification.