Earlier this month, SWIFT (Society for Worldwide Interbank Financial Telecommunication) published

the final results from its DLT (Distributed Ledger Technology or blockchain) proof

of concept for Nostro reconciliation.

Under the current correspondent banking model, a

correspondent bank provides services on behalf of another overseas financial

institution through a correspondent account (Nostro/ Vostro accounts).

Correspondent accounts are established through bilateral agreements between the

two banks.

According to a 2016 McKinsey report, on an average, 34% of

the cost of an international payment is related to Nostro trapped liquidity

caused by the absence of real-time data to optimise intraday liquity

management. Around 9% of the cost is linked to investigations or exceptions

mainly driven by a lack of standardisation in the end-to-end payment’s process,

and by the related Nostro account reconciliation.

SWIFT’s DLT POC, which started in

April 2017, sought

to test whether DLT can help banks reconcile Nostro accounts more

efficiently and in real-time, while lowering costs and operational risk. Preliminary

results were published

in October 2017.

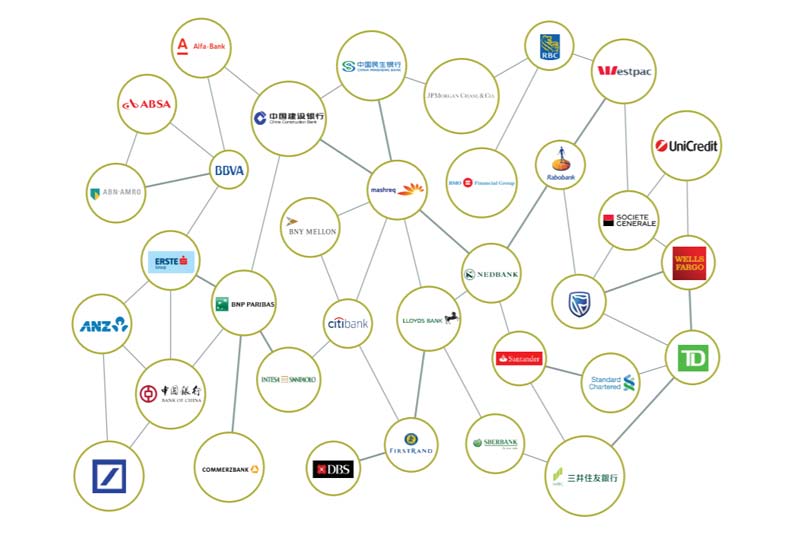

Participation from 34

banks

A total of 34 banks contributed to the proof of concept. They

were segmented in two groups working independently from each other. The initial

six financial institutions in the founding group worked with SWIFT to explore

and define the standards, data model, business and functional specifications,

that resulted in the creation of the concept model. They tested the application

and provided a number of change requests to improve the user’s experience of

the application, of which, a certain number were implemented prior to the start

of the final phase of testing with the validation group in September 2017.

The validation group of 28 financial institutions were

tasked with executing the same set of tests to provide independent conclusions

on the enhanced solution

The initiative was one of the most extensive blockchain

proofs of concept powered by Hyperledger Fabric 1.0 (Hyperledger is a global open

source collaborative effort created to advance cross-industry blockchain

technologies, hosted by The

Linux Foundation) executed in the industry till date, both in terms of

participant engagement and in terms of the scale of the infrastructure

deployed.

With the PoC SWIFT set out to work with the technology in a

“many-to-many” setting addressing a real business issue, and draw lessons for

larger scale implementations of the technology in the bank-to-bank payment

area. The PoC sought to assess whether DLT, combined with SWIFT assets, would

meet industry-level governance, security and data privacy requirements, whether

DLT could bring concrete benefits over other architectures, and to check DLT’s

current level of maturity to serve as a production-grade application within a

mission-critical global infrastructure.

Based on the business and technical requirements validated

by the participating banks, SWIFT developed a DLT solution through which Nostro

Account owners and their servicers could share a private confidential ledger

recording transactions related to their Nostro accounts.

The solution leverages ISO 20022 standards

and gpi

innovations – including the unique end-to-end transaction reference (UETR) –

and integrates intraday liquidity standards. The PoC was built within the SWIFT

DLT sandbox environment – a use case agnostic DLT platform which enables

experimentation and collaboration between SWIFT and its community.

The PoC showed that DLT could deliver the business

functionalities and data richness required to support automated real-time

liquidity monitoring and reconciliation. It enabled real-time event handling,

transaction status updates, full audit trails, visibility of expected and

available balances, real-time simplified account entries confirmation, the

identification of pending entries and potential related issues, and generated

the data required to support regulatory reporting.

The PoC also demonstrated the significant progress DLT has

made with regards to data confidentiality, governance, security, and

identification frameworks, showing that that the emergent technology, combined

with SWIFT assets, provides the necessary foundation for financial multi-bank

applications.

“The PoC went extremely well, proving the fantastic progress

that has been made with DLT and the Hyperledger Fabric 1.0 in particular”, said

Damien Vanderveken, Head of Research and Development at SWIFT. “The DLT sandbox

enabled us to control access, to define and enforce user privileges, to

physically segregate confidential data and store it only with the relevant

parties while supporting a strong identity framework by linking all

participants to their BIC, and having all keys signed by a SWIFT certification

authority”.

Pre-requisites for

industry adoption

However, the PoC also found that there are considerable

pre-requisites for industry adoption of such a solution. For instance, all

account servicers would first need to migrate from batch to real-time liquidity

reporting and processing. Today, 44% of cross border payments exchanged over

SWIFT generate a real-time confirmation of debit or credit.

While the DLT application could provide a platform to share

the information, significant work and investment would be required to upgrade banks’

back-office applications so that they can feed the platform with real-time

updates. The success of any solution will therefore depend upon deep

integration with back office systems using APIs. These implementation costs could

be significantly lowered should ISO 20022 standards be adopted first.

In addition, a value proposition for each market segment

catering for different levels of sophistication, automation of operations and

past investments would be key to ensure industry-wide adoption and coexistence.

For instance, the benefits of DLT for the larger clearing

banks are less clear since their dependency on external Nostro Servicer

providers is reduced overall when compared to mid-tier banks. Larger banks

typically manage their key currencies internally and have already invested

heavily in highly optimised liquidity and reconciliation tools.

To facilitate improvements in the Nostro process, SWIFT will

continue helping its community migrate towards real-time liquidity reporting

and processing through SWIFT gpi, and establish a roll-out plan for the

community-wide adoption of the UETR.

SWIFT will also initiate an ISO 20022 consultation with its

community to assess a timeline and a migration approach towards ISO 20022 as a

potential means to reduce integration costs, and will continue to actively

promote the re-use of ISO 20022 in the DLT context.

The PoC also showed that further progress is needed on the

DLT technology itself, before it will be ready to support production-grade

applications in large-scale, mission-critical global infrastructures.

For example, while 528 channels were required in the PoC to

ensure Nostro accounts would only be stored on the nodes of their account

servicers and owners, to productise the solution, more than 100,000 channels

would need to be established and maintained, covering all existing Nostro

relationships, presenting significant operational challenges.

Stephen Gilderdale, Chief Platform Officer, SWIFT, said, “It

is a strategic priority for SWIFT to work with new technologies like DLT and

incorporate them into key solutions like gpi. We are already working on new

PoCs and will continue our R&D efforts to ensure that SWIFT customers will

be able to leverage their existing SWIFT infrastructure and connectivity to

benefit from blockchain services, whether offered by SWIFT or by third parties,

on a secure and trusted platform.”