A local bank in Thailand plans to add an advisory feature to the Bualuang m-Banking mobile app in March 2020 as a means to generate fee income from the digital platform.

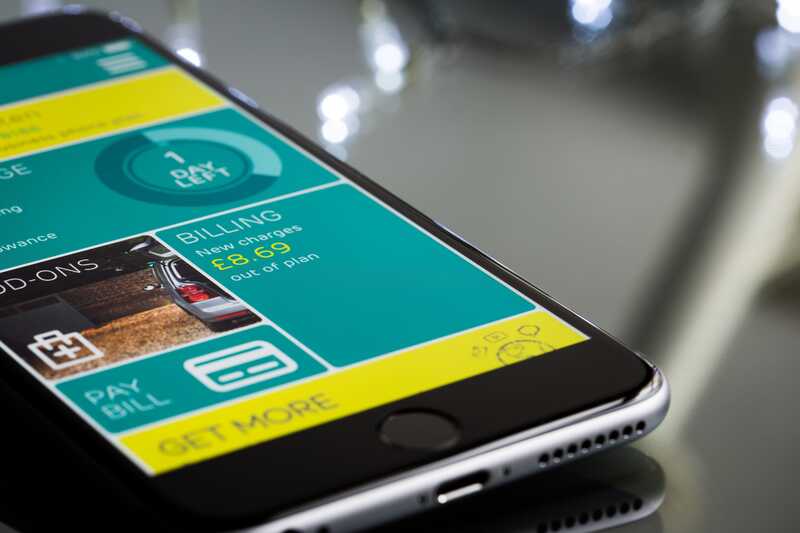

The new feature, covering mutual funds and bancassurance, will focus on transactional banking services to provide more convenience for customers and generate higher fee income for the bank, according to the Executive Vice-President.

The bank continues to expand financial products to traditional channels, while the digital platform will create more business opportunities and fee-based income. It also aims to offer digital loans to new customers through a partnership strategy.

The country’s third-largest lender by assets has collaborated with Thailand’s biggest cash-on-delivery (COD) operator, to offer digital loans to online merchants who are also clients.

Partnerships are the key strategy to expand digital loans covering both secured and unsecured financing this year. The two parties have collaborated with other business partners across several industries, including healthcare, for digital loan business expansion.

The Bualuang bank’s data analytics development will be a tool for the bank to keep a lid on bad loans.

The bank has begun with granting digital loans for its payroll customer base. This initial move has delivered positive growth so far, with a low non-performing loan (NPL) ratio of below 2%.

With these positive indicators, the bank is confident about the extension of digital lending services to new markets this year.

With additional features and entry into the new customer segment, the bank aims to have 10 million Bualuang m-Banking users by the end of the year and 11 million users in 2021, up from 8.2 million at the end of 2019.

Over the past three years, digital transaction growth averaged 120% per year. With these positive signs, the bank should adopt new features to match customers’ real needs.

In the same period, banking transactions made at brick-and-mortar branches and ATMs started to decline by 1-2%.

The bank plans to monitor the changing behaviour of consumers to bring traditional channels in line with demand across segments.

The bank is also focused on security amid exponential growth in digital banking transactions, noting that the bank had no system crashes in the final quarter of 2019.

Moreover, the bank informed mobile banking users about the Bank of Thailand’s security system requirements for mobile banking devices two months before the regulator’s announcement.

No devices with obsolete operating systems that are rooted or jailbroken have been spotted because the bank does not allow these devices to access Bualuang m-Banking, in compliance with the central bank’s requirements.

According to another article, the frequency of banking transaction crashes fell sharply in the third quarter after Thailand’s central bank imposed a measure to publicly disclose them, according to the Bank of Thailand data.

There were 12 glitches from July to September, compared with 32 in the previous quarter, which was the first time the central bank publicised names.

Mobile banking was at the centre of the transaction glitches in the third quarter, happening eight times, followed by ATM and cash deposit machines (CDMs), occurring three times, and the branch channel once.

In the second quarter, 21 crashes happened from mobile banking, eight from ATMs and CDMs, six from internet banking and three from the branch channel.

The influx of transactions during peak periods is the main cause of the crashes, so banks need to better manage traffic to alleviate the problems.

It was noted that three non-bank companies are applying to test out peer-to-peer (P2P) lending in the central bank’s regulatory sandbox. The experiment is expected to begin early this year.

Under the regulatory sandbox, the central bank requires potential P2P loan service providers to take into account both financial data and the behaviour of borrowers for loan analysis.

P2P lending will open opportunities to individual borrowers or small-business owners, who require small-ticket loans with a shorter maturity, to more easily access financial sources.