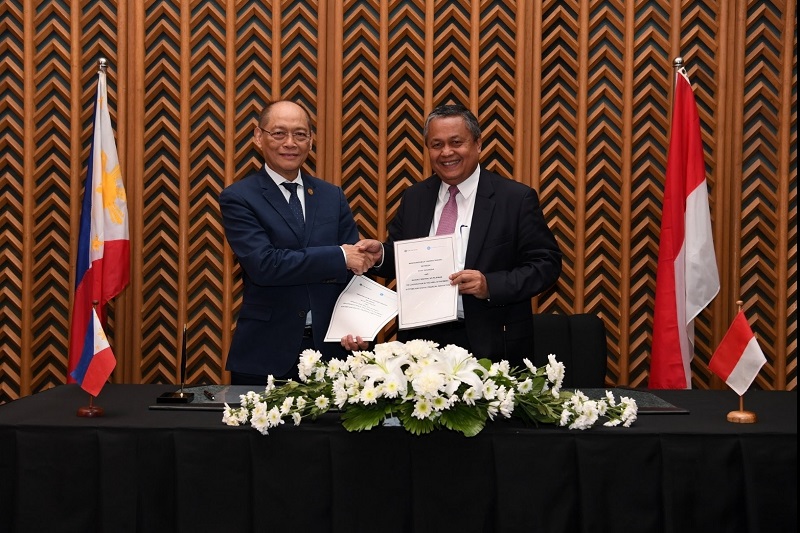

The Philippines and Indonesia, through their respective central banks, have signed a Memorandum of Understanding on cooperation in the area of payment systems and digital financial innovation.

According to a recent press release, the Bangko Sentral ng Pilipinas (BSP) and Bank Indonesia (BI) have expressed their commitment to strengthen bilateral cooperation in further enhancing mutual economic and financial system development.

The MOU aims to provide a framework for closer cooperation between the two central banks to achieve a more secure, efficient, and reliable payment system, and to promote digital financial innovation.

The MoU signing was held to conclude a bilateral meeting between the two central banks which fruitfully discussed numerous advances in digital economy and central banking, infrastructure financing using market instruments, and sustainable financing frameworks.

BSP Initiatives

OpenGov reported on several ICT initiatives that the Bangko Sentral ng Pilipinas had done to improve the Philippines’ financial ecosystem.

Before 2019 ended, the central bank has launched a set of milestone initiatives under the National Retail Payment System (NRPS).

These initiatives are the Government e-Payments (EGov Pay) Facility and the pilot of the first use case aligned with the National QR Code Standard (QR Ph).

EGov Pay

The EGov Pay facility is now fully launched to the public following a successful pilot run with the Bureau of Internal Revenue (BIR) last August 2019.

It is a payment solution that enables a streamlined digitalisation of government collections and disbursements.

By digitalising payments to the government, it is able to curb revenue leaks through efficient collection means, better audit trail, and enhanced transparency.

On the disbursement side, digital payment services help the government to promptly deliver social services through the quick and safe means of disbursement or paying out of funds to concerned stakeholders.

QR Ph

Six (6) pilot participants demonstrated how secure and easy transfer of funds is by scanning the QR code.

The funds are transferred through InstaPay, the real-time low-value ACH formed under the NRPS.

The use of QR codes for payments has been gaining traction as an alternative to the traditional debit and credit card payments.

The QR technology has emerged as the most expedient means of payment since it only entails code scanning, which is faster and easier than bringing out a card, tapping, dipping or swiping it, and signing a charge slip, in most cases.

AI and API

Two of the central bank’s initiatives were recognised at the Central Banking Fintech and Regtech Global awards.

The BSP won in the Artificial Intelligence Initiative category for its development of a prototype Chatbot to provide the public with a more accessible and efficient means to engage the central bank on financial consumer concerns.

Leveraging on AI and natural language processing (NLP), the Chatbot will be able to adequately and efficiently handle consumer concerns coursed through channels including SMS and social media.

The BSP also won in the Data Management Initiative category with the development of a prototype API-based prudential reporting system.

This initiative is part of the central bank’s continuing effort to strengthen its supervisory capacity in a rapidly evolving financial services landscape.

It provides a machine-to-machine link between the core banking systems of banks and the system of BSP.

This connection will allow for the streamlined transmission, processing, warehousing, and analysis of the banks’ prudential reports.

This will significantly improve the timeliness, ease, and integrity of data submission.

Cash-light economy

The central bank is positive that initiatives such as these will help boost digital transactions and support the roadmap of shifting from a cash-heavy to a cash-light Philippine economy.

This emanates from the recognition that digital payments are the gateway to financial inclusion.