SWIFT (Society for Worldwide Interbank Financial

Telecommunication) announced

on 23 March that it is extending its gpi

Tracker to cover all payment instructions sent across the network.

This will enable gpi banks to track all their SWIFT payment instructions at all

times, providing them full visibility over all their payment activity.

The Tracker, available since May 2017, enables banks that

have signed up to SWIFT

gpi to track their gpi payments in real-time. The Tracker can be

updated by FIN

message or via API. It can be accessed via a graphic user interface (GUI) and

also via API calls to allow the service to be embedded in other back-office

systems.

The Tracker provides automatic status updates to all gpi

banks involved in any gpi payment chain and allows them to confirm when a

payment has been completed. The Tracker also facilitates more accurate

reconciliation of payments and invoices, helps optimise liquidity with improved

cash forecasts and reduces exposure to FX (foreign exchange) risk, with

same-day processing of funds in beneficiaries’ time zones. However, the Tracker

was only available for transfers within the gpi network.

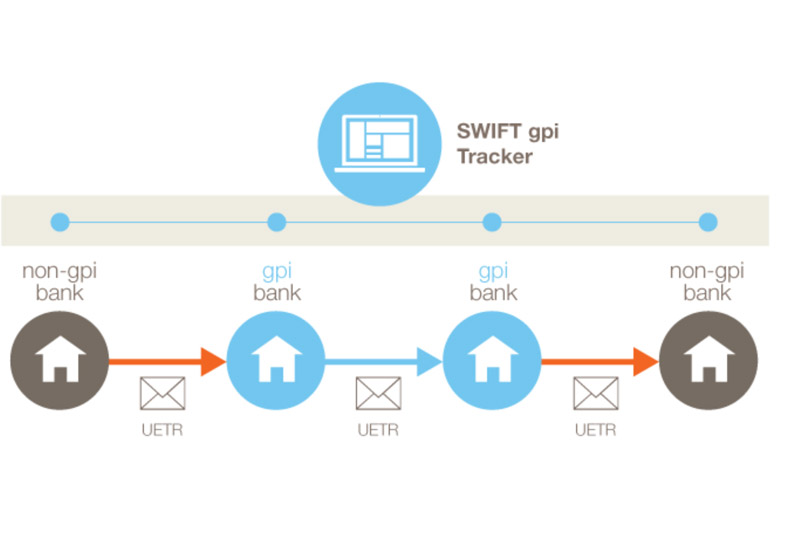

From 18 November this year, a unique end-to-end

transaction reference (UETR) will be included in all payment instructions

carried between all 11,000 customers on SWIFT across more than 200 countries

and territories.

The introduction of

the UETR in payment instructions will be effected through the mandatory annual Standards MT Release in

November. Following the release, all SWIFT customers will be required to

include the UETR in their payment instructions, irrespective of

whether they are gpi banks and or whether they are executing gpi payments, introducing

greater transparency and reducing costs.

“The extension of the Tracker to non-gpi payments is a major

step forward. It will significantly extend transparency and it will drive more

banks to join the service, rapidly making gpi the new normal in cross-border

payments”, said Navinder Duggal,

Group Head of Cash Product Management from DBS, one of the early gpi

adopters in Asia.

Lars Sjögren, Global

Head of Transaction Banking, Danske Bank, commented, “Enabling

end-to-end tracking of all payment instructions through to the end destination

is a game-changer. Until last year, it was impossible for banks to gather this

information on behalf of their customers, but the introduction of the gpi

Tracker has addressed this challenge head on, transforming cross-border

payments and dramatically improving the service that banks can offer to their

customers in a very cost efficient way.”

“SWIFT gpi has been hugely beneficial for banks and their

customers since its launch, but extending this tracking facility across all

payments traffic will be truly transformational. These expanded tracking

capabilities are part of a series of gpi services we will roll out in 2018 to

further improve the cross-border payments experience, enable banks to provide a

far superior service to their customers and rapidly attract more banks to join,”

added Harry Newman, Head of

Payments at SWIFT.

SWIFT

gpi was launched in 2017 and it accounts for 10% of SWIFT cross border

payment traffic, enabling more than a hundred billion dollars to be transferred

across the world rapidly and securely every day.

More than 150 banks, representing over 78% of SWIFT’s

cross-border payments traffic, have signed up to the service, sending hundreds of

thousands of payments daily across 220 country corridors – including major

corridors such as USA-China, where gpi already accounts for more than 25% of

payment traffic. Nearly 50% of gpi payments are completed in less than 30

minutes, many within seconds.

The aim is to make SWIFT gpi the standard for all

cross-border payments made on the SWIFT network by the end of 2020.