|

Getting your Trinity Audio player ready...

|

In the U.S., collaboration between various entities is paramount to creating a sustainable digital technology acceleration, especially in the financial sector. As a country that values innovation and economic growth, the United States recognises the importance of fostering collaboration among different entities to propel digital technology in the financial sector. This collaboration involves key players such as government agencies, financial institutions, technology companies, regulatory bodies, and academic institutions.

In academia, industry, and government, a team of experts has published a comprehensive paper in Nature Reviews Physics, establishing a definitive resource on the utilisation of quantum computers to expedite solutions for the finance sector. The study, facilitated by the collaborative intellectual hub in Chicago, addresses challenges in optimisation, machine learning, and stochastic modelling at the intersection of finance and computing.

The team includes scientists from the U.S. Department of Energy’s Argonne National Laboratory, an American multinational financial services firm, a Research firm, and another private company which specialises in quantum computing, the University of Chicago’s Pritzker School of Molecular Engineering, and the University of Delaware. The CQE, an intellectual hub fostering collaboration between academia, government, and industry for quantum research, played a pivotal role in bringing these diverse expertise together.

The report is intentionally crafted for researchers who may be something other than quantum computing experts. Marco Pistoia, Head of Global Technology Applied Research at an American multinational financial services firm, expressed, “We wanted this to be appreciated by a larger audience. Our paper can be the starting point for researchers to understand the landscape better and then dive deeper into the areas that they’re interested in.”

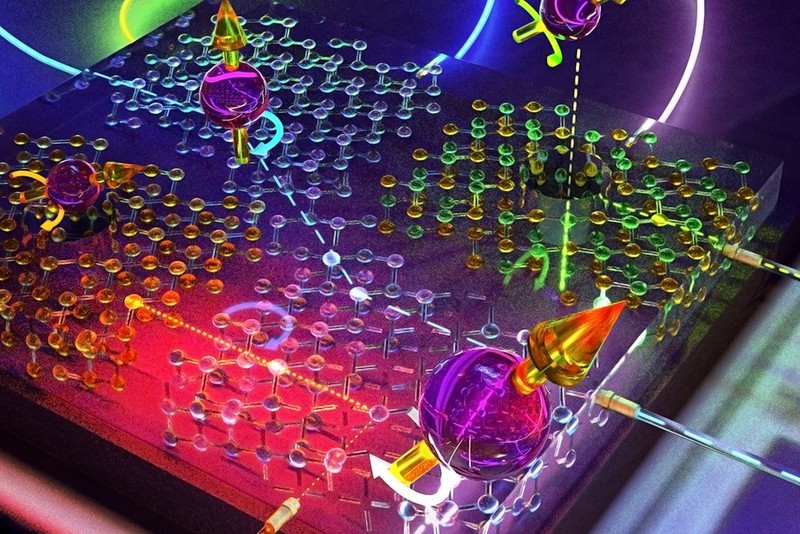

Quantum computing, harnessing the principles of physics at the atomic level, outpaces traditional computing by performing computations at unprecedented speeds. A quantum computer can accomplish in minutes what would take a supercomputer 10,000 years. Yuri Alexeev, an Argonne scientist and co-author of the report, highlighted the enormous potential speedup offered by quantum computing, “We are talking about a potential speedup of millions of times for solving certain problems.”

The finance sector is particularly intrigued by the supersonic speed advantage that quantum computing offers. In finance, where time and accuracy are critical, the ability to obtain solutions rapidly can yield substantial benefits.

The report delves into three critical categories of challenges: optimisation, machine learning, and stochastic modelling. Optimisation involves rapidly obtaining the best solution to a problem, enabling financial companies to select assets for maximum returns with minimal risk. The integration of quantum algorithms with machine learning, the second category, enhances the speed of predictions, crucial for understanding patterns in the stock market. The third category, stochastic modelling, is revolutionised by quantum computing, providing faster and more accurate predictions about market evolution.

Convening different sectors to apply quantum technology solutions to industry challenges has been a central focus of the CQE. The Bloch, a CQE-led coalition, has played a vital role in positioning Chicagoland as a U.S. Regional Technology and Innovation Hub for quantum technologies. With a potential project funding of up to US$70 million, The Bloch aims to build capacity for quantum companies, create pathways for quantum jobs, and establish end-to-end quantum industry solutions, including in the finance sector.

As highlighted in the report, the collaboration signifies a pivotal moment in quantum computing for finance. Pistoia emphasised, “All the work we examined confirms that quantum computing for finance is a vibrant field.”

The collaboration between academia, industry, and government sets the stage for quantum computing to revolutionise financial solutions, marking a significant leap forward in the intersection of digital technology and the finance sector.

Looking ahead, the collaborative efforts showcased in this quantum computing endeavour are poised to redefine the landscape of financial solutions. As the finance sector braces for a future characterised by ever-increasing complexity and data-driven challenges, quantum computing emerges as a transformative force capable of unlocking new possibilities.