The Chief Executive of the Hong Kong Monetary Authority (HKMA) stated that fintech development in Hong Kong has gathered remarkable momentum ever since the first FinTech Week three years ago.

The HKMA CE made these remarks in his speech at the Hong Kong FinTech Week 2019, a five-day event that has attracted thousands of attendees across the globe.

The HKMA also took the chance to highlight a series of initiatives aimed to foster the fintech ecosystem in Hong Kong.

The subsidiaries of Hong Kong Interbank Clearing Limited and Institute of Digital Currency of the People’s Bank of China signed a Memorandum of Understanding (MoU) on Wednesday to connect the digital trade finance platforms of Hong Kong and the mainland.

The HKMA said that once the connection has successfully been established, it will provide firms in both places with more convenient trade finance services and enable banks in Hong Kong to expedite the expansion of their trade finance business.

Additionally, the HKMA said, as a follow-up to the MoU signed between the HKMA and the Bank of Thailand in May 2019, the two authorities are conducting a joint research project named Project LionRock-Inthanon to study the application of central bank digital currency to cross-border payments.

The first Innovation Hub of Bank of International Settlements commenced its operation in Hong Kong in November 2019, which the HKMA said is a testimony that Hong Kong stands at the forefront of fintech innovation.

The HKMA said it believes that the Innovation Hub Hong Kong Center will serve as a focal point for regional fintech collaboration and bring the application of innovative technologies among central banks to a new level.

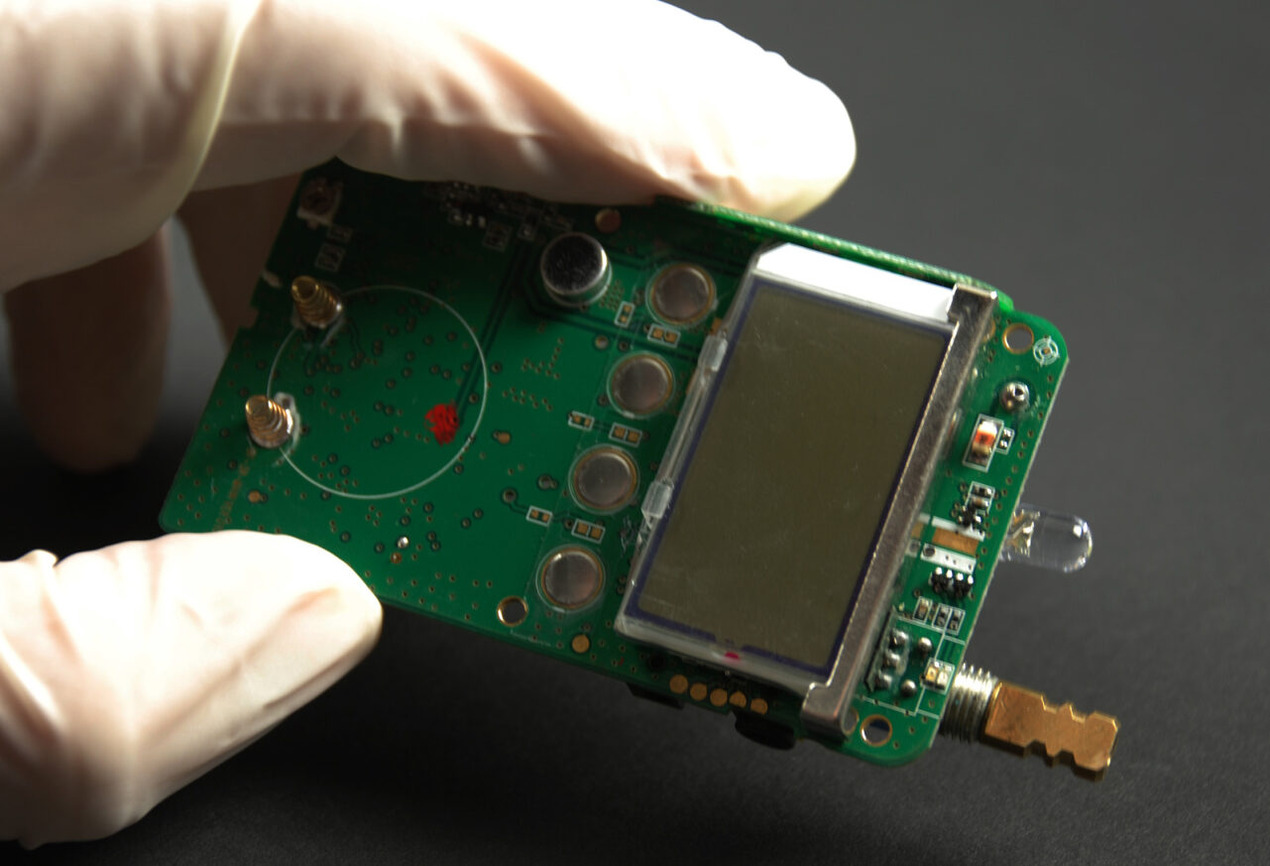

Initially, the HKMA will explore with the Hong Kong center on the use of Distributed Ledger Technology to digitalize trade finance processes and study the impact of big tech to financial markets.

The HKMA said it is also conducting a study on the application of Artificial Intelligence (AI) technology in the banking industry.

A fact sheet released by the monetary authority on Wednesday showed that almost 90 per cent of the surveyed retail banks have adopted or plan to adopt AI applications.

The survey included interviews and questionnaires conducted with banks, industry organizations, and fintech firms, with a view to understanding the current AI landscapes in the banking industry.

Recently, the HKMA jointly launched the Fin+Tech Collaboration Platform with the Hong Kong Science and Technology Parks to support fintech development in Hong Kong in a technology-centric approach.

Industry players can make use of the platform to organize fintech-related activities to explore innovative solutions, identify talents, and seek collaboration opportunities, according to the HKMA.

The HKMA CE noted that the HKMA’s fintech initiatives have successfully created a vibrant fintech ecosystem. He is looking forward to partnering with various partners including financial institutions, end-users, start-up firms, technology service providers, investors and regulators to walk towards the shared purposes of driving innovation, enhancing customer experience and facilitating financial inclusion.

Hong Kong is Asia’s FinTech hub

According to an earlier report by OpenGov Asia stated that Hong Kong is one of the few places in the world that attracts FinTech companies from both East and West.

The city has had a longstanding reputation for being welcoming of business and talent. This is reflected in it being named the world’s freest economy for the 25th consecutive year in January 2019.

Moreover, Hong Kong is the world’s third-largest and Asia’s biggest financial centre. It is also second in the world for insurance and number one in Asia for asset management.

The city also provides companies from overseas a combination of location, infrastructure, financial hub, legal system and local talent that simply cannot be matched elsewhere.