|

Getting your Trinity Audio player ready...

|

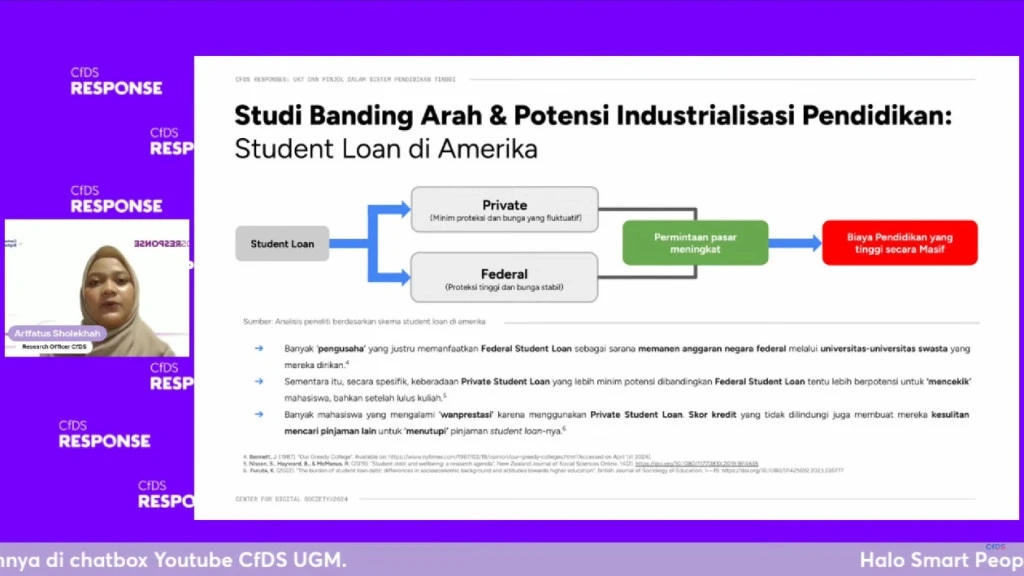

In an era where educational affordability is increasingly crucial, integrating digital technology in financing student tuition fees is becoming a game changer in Indonesia. This transformative approach, particularly through innovative online loan schemes known as “pinjol,” is currently a topic of discussion among various stakeholders, ranging from university administrators to students. This shift towards digital solutions in education finance marks a significant move towards modernising and streamlining the process of managing educational expenses.

The Centre for Digital Society (CfDS) at Universitas Gadjah Mada (UGM) has been analysing these digital financial services. Their research series “Is Pinjol Truly a Solution to the High Costs of Student UKT?” leverages advanced digital data analysis and comprehensive desk studies to explore new educational financing models. This initiative aims to scrutinise and evaluate the efficacy and implications of these digital financing solutions in a rigorous academic context.

Achmed Faiz Yudha Siregar, a Research Officer at CfDS, has taken the step of this research project. The investigation was spurred by a surge of online discussions and promotional materials starting in January 2024, featuring various online loan services partnered with universities. These partnerships aim to assist students in managing their Single Tuition Fee (UKT) through manageable instalment plans, indicating a progressive integration of technology into educational systems to help alleviate financial burdens.

The research team, including experts such as Arifatus Sholekhah, Alifian Arrazi, Bangkit Adhi Wiguna, and Falah Muhammad, has critically assessed public sentiment regarding these digital loan schemes. Their findings reveal a new perspective among the public towards this new method of financing education.

Despite some concerns about the potential for these schemes to become debt traps, the overall sentiment is that digital approaches to student loans represent a step forward in making education more accessible and manageable for a larger population segment.

Moreover, this shift towards digital financing methods reflects a broader evolution in Indonesia’s funding models for higher education. Since the transformation of State Universities into legally incorporated entities (PTN-BH), there has been a substantial alteration in their funding structures.

This change has created a pressing need for innovative solutions like pinjol to bridge the funding gap, ensuring that higher education remains accessible to more students. By adapting to these changes, educational institutions can continue providing valuable learning and advancement opportunities in an increasingly digital landscape.

The comprehensive report from the CfDS has underlined the critical need for better-structured, more inclusive financing policies within the educational sector. It calls upon the government to substantially increase its support by allocating additional funding and resources. Specifically, the report advocates for creating more sustainable and socially responsible financing models. Additionally, it emphasises the importance of leveraging advanced digital technology to establish robust support systems that can enhance accessibility and efficiency in student aid programmes.

In alignment with these recommendations, Universitas Gadjah Mada has taken steps by launching the 2024 UGM Scholarship, notably funded by the revenues from the 2023 Superior Education Solidarity Contribution. UGM ensures that financial aid is more accessible to a wider range of students, thus embodying the transformative impact of digital technology on education financing.

Besides empowering students by providing necessary financial support more efficiently and transparently, it also sets a benchmark for other educational institutions, demonstrating the potent role of technology in tackling the pressing issue of educational affordability across Indonesia, and amplifying the broader impact of digital solutions in educational finance nationally.

In the future, the digital transformation of education finance will continue to evolve, with several key trends and developments anticipated. One significant advancement is the integration of artificial intelligence (AI) and machine learning (ML) algorithms into student financial services that can analyse vast amounts of data to personalise financial advice to individual students based on their unique circumstances and needs.

Additionally, blockchain technology is envisioned to play a more prominent role in ensuring the transparency and security of financial transactions. Using blockchain-based systems, educational institutions can streamline the disbursement of funds and verification of student credentials, reducing administrative costs and preventing fraud.

Moreover, as the digital economy continues to grow, new forms of financing, such as crowdfunding and peer-to-peer lending, may become more prevalent in education finance. These alternative financing models can provide additional options for students who may not qualify for traditional loans or scholarships.

The future of education finance in Indonesia and globally will be shaped by continued innovation and integration of digital technologies, ultimately ensuring that education remains a transformative and empowering force for all.