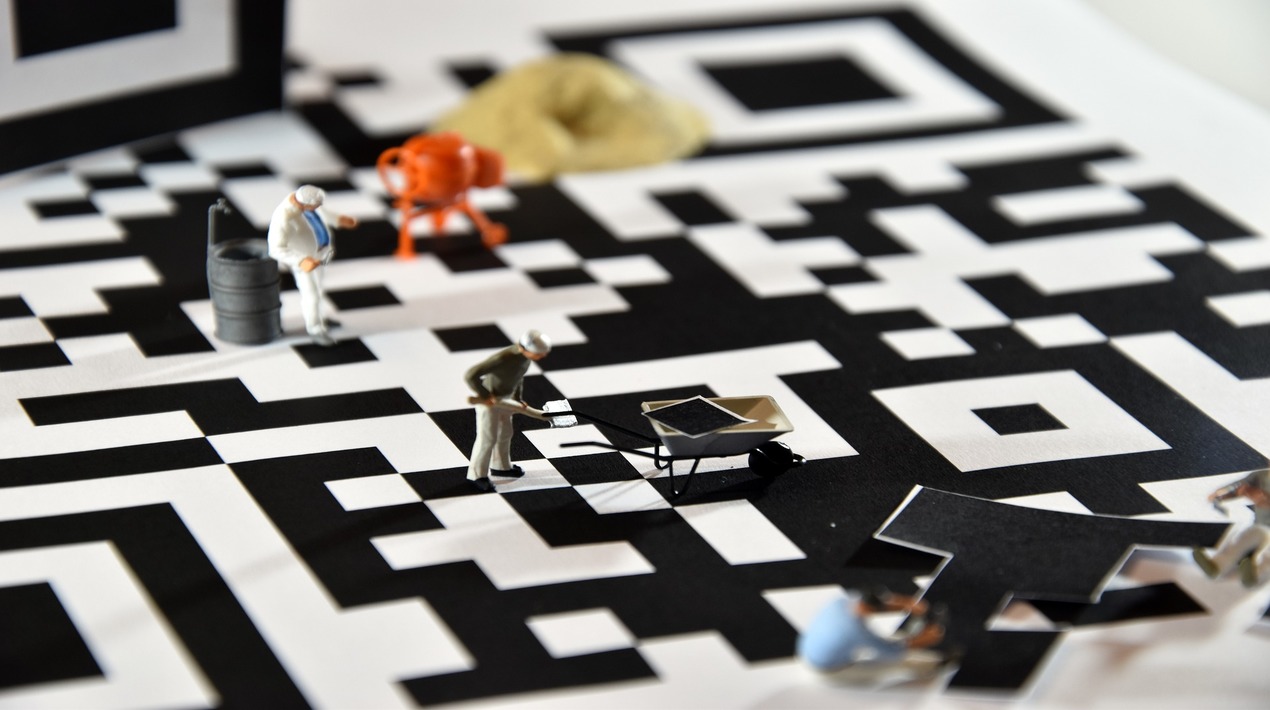

We are all familiar with the iconic black and white square design of a QR code today. The steadily increasing penetration of smartphones and access to high-speed internet has resulted in the widespread use of QR codes.

One of the most significant advantages of using QR codes is that it allows for instant payment. When compared to other modes of payment, paying with QR codes is extremely fast. To process the payment, a user only needs to open the QR code scan app, scan the QR code, and confirm. The payments are made in a matter of seconds.

In addressing this, electronic payments, which have grown in popularity since the government-imposed movement restrictions at the start of the pandemic, are expected to increase even more with the use of QR codes for payments. The Bangko Sentral ng Pilipinas (BSP) payment system is said to be using the quick response (QR) code as a catalyst to drive digital payments in the country.

An executive vice president of a commercial bank in the Philippines mentioned in a virtual briefing that the interoperability of the codes under the QR PH programme, which uses QR technology in financial transactions, provides significant potential for electronic payments.

He noted that the bank’s app-based digital prepaid bank account product will benefit greatly from the QR PH programme, particularly with the increase in merchants with whom account holders can easily transact.

“We see a lot of potential for these QR payments. We have onboarded a lot of merchants and definitely, coupled with the QR PH interoperable QR PH QR codes, we see more digital payments,” he added. QR PH is among the programmes of the central bank eyed to increase the share of digital payments in the total financial transactions in the country.

In addition, the BSP recently unveiled the QR PH person-to-merchant (P2M) payment facility, an electronic payment system that allows buyers to pay for small-value transactions such as jeepney or tricycle fares, as well as payments of goods and services to micro, small, and medium-sized enterprises (MSMEs) at no cost to the buyer.

This payment technique involves the buyer scanning the seller’s or service provider’s QR code to pay for an item or service. The central bank wants digital payments to account for roughly 20% of all financial transactions in the country by 2020, which the BSP stated has been significantly exceeded, and to account for around 50% of the total by 2023.

OpenGov Asia in an article reported that the QR PH P2M runs its operations using one of the two electronic payment facilities provided by the central bank’s National Retail Payment System (NRPS). He then noted that they anticipate an increase in the number of QR PH P2M participants in the coming days and that using the QR code is less expensive than using a point-of-sale (POS) terminal. It is also mentioned that the QR PH empowers consumers by allowing them to choose their digital payment service through the interoperability feature of QR PH payments, which is in line with the United Nations’ principles on the responsible use of digital payment.

The Philippines’ central bank has announced that digital payments have surpassed the central bank’s target of 20% of total monthly payment volume by 2020.

According to the executive vice president, the bank responded to the central bank’s request by launching a digital prepaid card in the fourth quarter of 2019 that has nearly 2 million customers. Users of digital prepaid bank accounts can access their accounts, make virtual fund transfers, pay bills, conduct electronic loading, and pay with a QR code, among other things.