|

Getting your Trinity Audio player ready...

|

The Monetary Authority of Singapore (MAS) has unveiled a trio of pioneering initiatives aimed at ushering in a new era of digital transactions. The agency is injecting enthusiasm and innovation into the digital currency realm with a strategic plan for safety and efficiency.

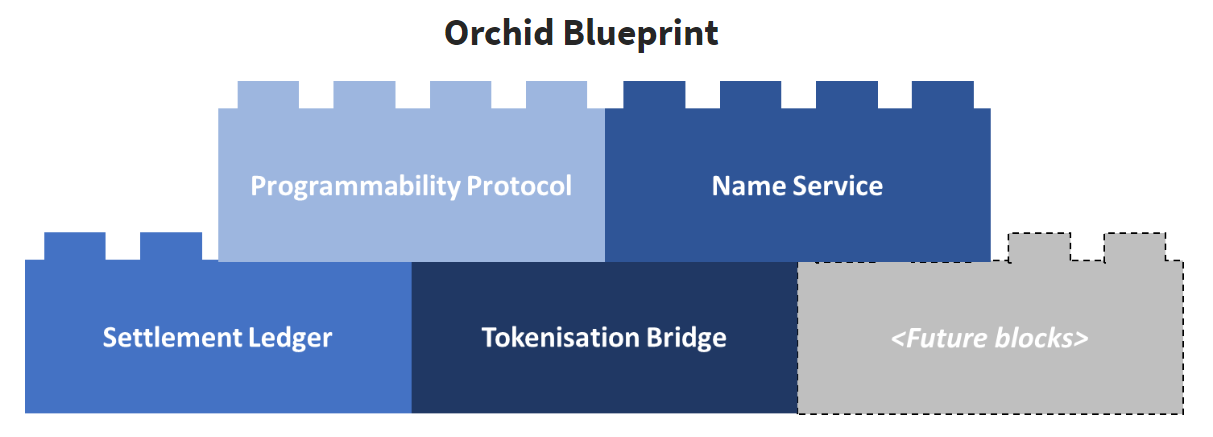

At the core of MAS’s vision is the Orchid Blueprint, a dynamic guide mapping out the intricate infrastructure necessary for a digital Singapore dollar. Derived from the practical insights of Project Orchid’s industry trials, this blueprint offers a strategic roadmap for the seamless integration of digital money in the nation.

The settlement ledger emerges as a digital ledger recording the ins and outs of digital money transfers. But it’s not just a record; it boasts native programmability and atomic settlement features, making it a superhero in the digital transaction space.

The tokenisation bridge acts as a seamless connector between existing settlement systems and tokenised digital money, ensuring a smooth transition. The programmability protocol serves as a common language, ensuring universal comprehension in the area of digital money.

Besides, MAS has groundbreaking trials that are pushing the boundaries of what’s possible with digital money:

- Tokenised Bank Liabilities: Exploring the universality of bank tokens, irrespective of the issuing bank.

- Wallet Interoperability: Teaming up to facilitate secure transactions using the Purpose Bound Money (PBM) concept, allowing digital payment merchants.

- Supplier Financing: Venturing into the tokenisation of payables, unlocking liquidity and easing financial burdens.

- Institutional Payment Controls: Enabling institutional clients to transfer deposit tokens beyond the issuing bank’s customer base, ushering in a new era of peer-to-peer transfers.

MAS is not stopping at trials; they are gearing up to issue a “live” central bank digital currency (CBDC) for wholesale settlement. No longer a simulation, this pilot involves using CBDC to settle retail payments between commercial banks, marking a significant milestone in MAS’s digital money journey.

Ravi Menon, Managing Director of MAS, summed it up eloquently, stating that the “live” issuance of CBDC is a significant milestone. It’s not just about digital money; it’s about using central bank money to facilitate payments safely and efficiently.

As Singapore embraces this digital revolution, he added, MAS’s approach injects a sense of dynamism into an otherwise technical narrative. It’s an invitation to buckle up and be part of a journey where the possibilities of digital innovation unfold in real-time. “The digital future is not a distant vision; it’s a thrilling adventure that Singapore is embarking upon with MAS at the helm.”

In addition to heightened efficiency, digital money introduces a paradigm of cost-effectiveness. Security emerges as a cornerstone advantage of digital money, primarily owing to the robust blockchain technology underpinning its functionality.

Digital money becomes a potent tool for advancing financial inclusion, providing a gateway for individuals who are unbanked or underbanked to access essential financial services. With just an internet connection, people across the globe can participate in economic activities, thereby narrowing the financial divide and promoting inclusivity.

Moreover, the advent of digital money stimulates a culture of innovation within the financial sector. This innovation is evident in the development of new payment systems, and financial products, and the rise of decentralised finance (DeFi) platforms.

As technology advances further, these multifaceted advantages of digital money are poised to play an increasingly pivotal role in shaping the future of global financial ecosystems. The ongoing evolution of digital currencies holds the promise of not only addressing current financial challenges but also laying the groundwork for a more inclusive, secure, and innovative financial future.