The HKU FinTech Index Series Project released the Hong Kong FinTech Buzz Index (FBI) for the second quarter (Q2) of 2020 on 17 August 2020.

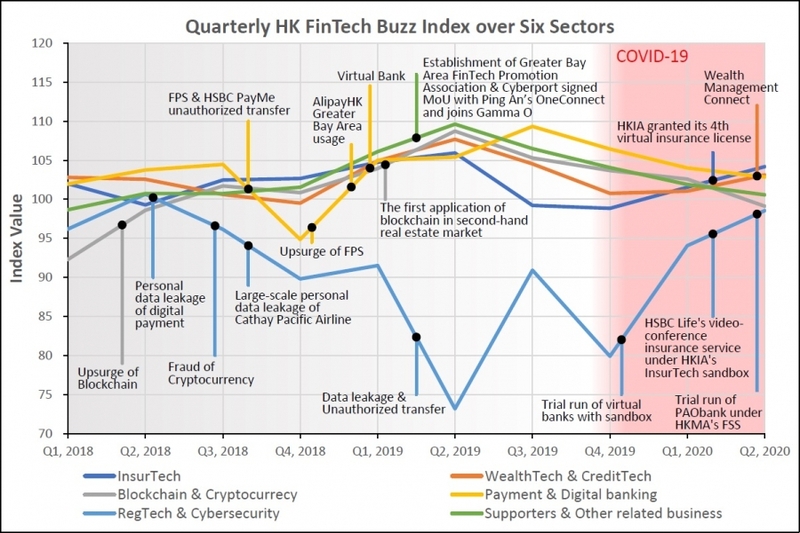

According to the 1,190 news articles analysed in the past three months, the FBI for the second quarter (Q2) of 2020 is 101.6, a slight decline of 0.1 index point (or 0.10%) from 101.7 in the first quarter of 2020. The index decreased by 3.1 points (or 2.96%) from the peak value of 104.7 in Q2, 2019. Despite the strong growth of RegTech and InsurTech this year, the Hong Kong FBI was flat under the ongoing COVID-19 pandemic.

Hong Kong FinTech Buzz Index (FBI) is a quarterly index that represents a quantified sentiment of the local FinTech-related news articles in local Chinese news media. Performance differed across the six subsectors, with a rise recorded in the sub-indices of Insurance Technology (InsurTech), Wealth Technology and Credit Technology (WealthTech & CreditTech) and Regulatory Technology (RegTech) & Cybersecurity.

The rise in the InsurTech sub-index can be attributed to positive news reports from the Hong Kong Insurance Authority’s granting a 4th virtual insurance license to a Chinese online-only insurance company. The announcement of Wealth Management Connect by HKMA also brought good news to the WealthTech & CreditTech sector.

Positive news reports leading to the rise in RegTech sub-index are mainly on the trial run of a subsidiary of a leading technology-as-a-service platform for financial institutions in China. This subsidiary is committed to establishing a virtual banking ecosystem in Hong Kong by optimising customer-centricity services through its innovation and sophisticated technology. The project was awarded a trail under the FinTech Supervisory Sandbox by HKMA.

About the HKU FinTech Index Series Project

The HKU FinTech Index Series Project introduces the Hong Kong FinTech Growth Index (FGI) and the Hong Kong FinTech Buzz Index (FBI) to gauge local FinTech companies’ outlook on the industry and the general sentiment on the sector as reported by the local press. It is the first in the region to provide index indicators on the development of the sector, intending to provide information promptly to track the growth and development of the financial technology industry in Hong Kong.

FGI is a yearly index with four sub-indices on Business Environment, Business Performance, Investment on R&D and Demand on Talent. It reflects Hong Kong FinTech sector’s forecast of the market situation in the coming year and assesses the situation in the current year. FBI is a quarterly index representing a quantified sentiment of the local FinTech-related news articles in Chinese for the past three months.

The index has a base value of 100 points which represents the sentiment of nearly 10K FinTech related news articles in major local news media outlets in 2016 and 2017. FBI is further broken down into six sectors: Insurance Technology (InsurTech), Wealth Management and Credit Technology (WealthTech & CreditTech), Blockchain & Cryptocurrency, E-Payment & Digital Banking, Regulatory Technology (RegTech) & Cybersecurity and other related business including AI and big data.

The project was initiated by the technology transfer company of the University and is led by a doctor at the Department of Statistics and Actuarial Science of the Faculty of Science.

About HKU FinTech Index Advisory Board

The Advisory Board comprises professionals from the University of Hong Kong and the local FinTech industry, including representatives from FinTech Association of Hong Kong, InvestHK, Cyberport, Hong Kong Science and Technology Parks Corporation, and a major bank.

The members provide expert advice on the FinTech companies to be included in the master list for the annual survey to return the FinTech Growth Index. They also advise the Project on index methodology.