The Hong Kong University of Science and Technology (HKUST) signed a Memorandum of Understanding (MOU) with one of the “big four” banks in the People’s Republic of China (the Bank) on 1 April 2021 to co-organize a master program in Financial Technology (MSc in Fintech) in the new academic year – the first such program in the Greater Bay Area.

The collaboration – which also includes a mini-MBA program targeting micro, small and medium enterprises (SME), and the Bank sharing financial cases and data with HKUST for relevant joint research projects – sets a new model for youth exchanges and financial connectivity between Hong Kong and the mainland.

According to the agreement, the Bank will recommend qualified candidates – not confining to the Bank’s staff, to join HKUST’s MSc in Fintech program every year.

Meanwhile, the Bank will also open some of its practical financial courses and facilities at its South China Campus to all HKUST students of the MSc in Fintech program, who can apply for elective courses there and participate in exchange visits and internship training.

Candidates who complete the master program will receive a certificate of completion, while those who meet the graduation requirements will be awarded a degree certificate from the HKUST.

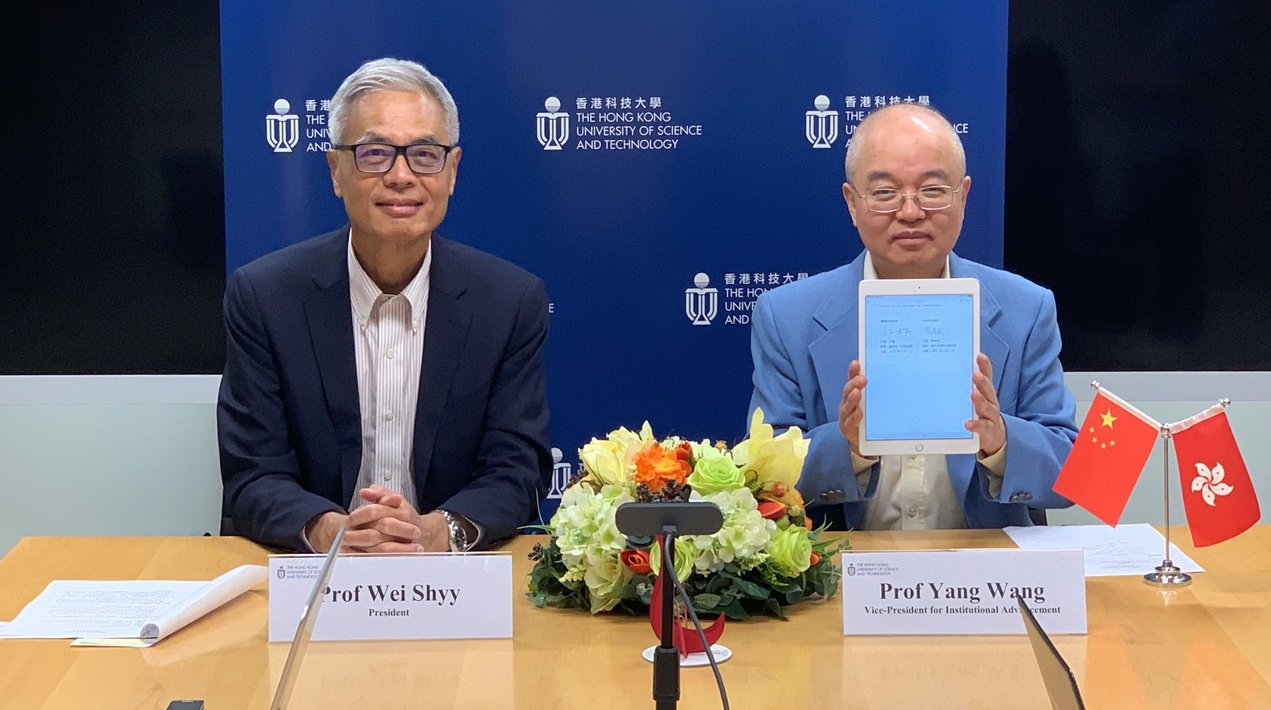

The signing ceremony was conducted via video conference in Hong Kong and Beijing in light of the COVID-19 pandemic. Under the witnesses of the Deputy Director of the Hong Kong and Macau Affairs Office of the State Council; the Deputy Director of the Central People’s Government Liaison Office in Hong Kong; the Chairman of the Bank; the Vice-President of the Bank; the President of HKUST; and representatives of the Ministry of Education.

The HKUST Vice-President for Institutional Advancement and a representative of the Bank signed the agreement.

The HKUST President stated that the University welcomes the partnership at the ceremony. He noted that this collaboration marks forward-looking and open cooperation between academia and enterprises. As a leader in the banking sector, the Bank has been actively promoting the development of Fintech.

“We will leverage this opportunity and make good use of HKUST’s substantial strength in Fintech related expertise to further promote [the] implementation of the technology, as well as nurturing more Fintech professionals with diverse background and experiences to advance their innovative ideas and relevant expertise,” he said.

The Chairman of the Bank stated that the cooperation seeks to set an example of bank-university cooperation between Hong Kong and the mainland and to drive innovation in the cross-border integration of youth, enterprises and academia.

Apart from nurturing high-calibre financial talents and showing them the latest trends in Fintech, the scheme will also facilitate Hong Kong students to have a better understanding of the mainland, and vice versa.

Meanwhile, the collaboration will also enhance the financial knowledge of SME owners as well as our ability to provide better full-lifecycle financial services for them.

Apart from the program, the parties have also planned to launch wide-ranging collaboration including a mini-MBA program for SME owners as well as other short-term training courses. The mini-MBA program aims to open in September 2022, will focus on the exploration of an effective model that could help SMEs to solve their operational and financing obstacles.

Meanwhile, the Bank will provide HKUST students with internship opportunities, entrepreneurial mentorship and financial support. The two parties will also launch activities such as entrepreneurship competitions.

HKUST has stepped up cooperation with the Bank since signing a framework agreement on cooperation in October 2018. One of the landmark projects was the “Certified Fintech Practitioners Training program” – an accredited training program co-developed among HKUST, the Bank, the China Banking Association and Shenzhen University, which has trained and certified more than 6,000 Fintech professionals to this date.