Image from page 8 of Digital Planet 2017 report

The Fletcher School at Tufts University in partnership with Mastercard today released the Digital Evolution Index (DEI) 2017. This comprehensive research tracks the progress countries have made in developing their digital economies and integrating connectivity into the lives of citizens. It is a research product of Digital Planet, an interdisciplinary research platform, based at the Institute for Business in the Global Context at The Fletcher School at Tufts University.

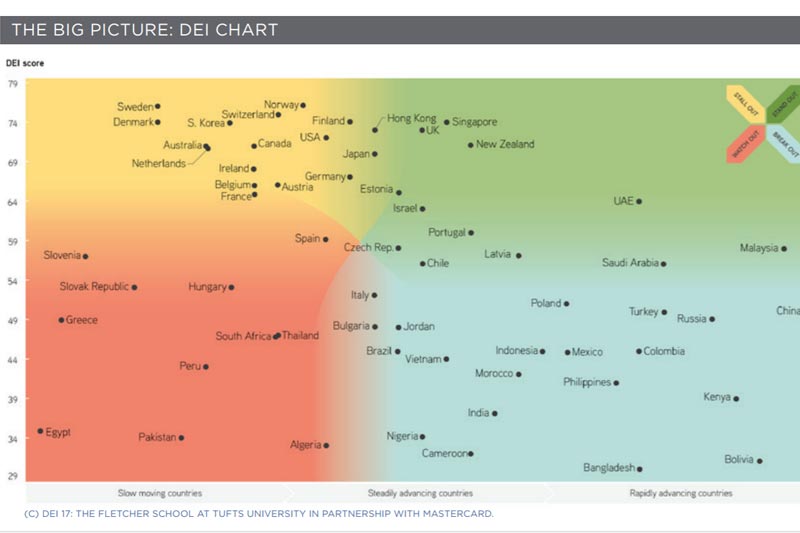

The research maps the development of 60 countries, demonstrating their competitiveness and market potential for further digital economic growth. The Index measures 170 unique indicators over four key drivers: Supply (or internet access and infrastructure), Consumer demand for digital technologies, Institutional environment (government policies/laws and resources) and Innovation (investments into R&D and digital start-ups etc.). It utilises data over 8 years (2008 – 2015) to provide an overall digital evolution score and digital momentum score, as well as a measure for digital trust, which is a new addition in this year’s index.

The top 10 countries globally in descending order of ranks are Norway, Sweden, Switzerland, Denmark, Finland, Singapore, South Korea, UK, Hong Kong (Hong Kong, a Special Administrative Region of China, is looked at as a separate entity) and USA. China is at the top of the momentum rankings. It is outpacing the rest of the world in areas like mobile payments, online dating, and peer-to peer lending via mobile services and is expected to lead in the creation and export of mobile technologies going forward.

Then DEI moves on to a nuanced classification of the countries, revealing weaknesses among some of the highly ranked countries and the potential in some nations with currently low scores in digital advancement.

From Stand Outs to Watch Outs

The DEI framework segments the 60 countries into Stand Outs, Stall Outs, Break Outs and Watch Outs.

Stand Out countries (examples- Singapore, the United Kingdom, New Zealand, the United Arab Emirates, Estonia, Hong Kong, Japan, and Israel)

These countries are both highly digitally advanced and exhibit high momentum in terms of the pace of change in their digital evolution The report notes that sustaining consistently high momentum over time is challenging, as innovation-led expansions tend to be lumpy phenomena. Hence, these countries ‘need to keep their innovation engines in top gear’ and generate new demand to avoid stalling out.

Stall Out countries (examples- Many developed countries such as in Western Europe, the Nordics, Australia and South Korea)

These countries enjoy a high state of digital advancement while exhibiting slowing momentum. In fact, the five top scoring countries in the DEI 2017 ranking—Norway, Sweden, Switzerland, Denmark, and Finland—are all in the Stall Out zone reflecting the challenges of sustaining growth. These countries would need reinvent to go beyond their “digital plateaus”, possibly by focusing on a rising digital technology in which they have leadership.

Break Out countries (Examples- China, Kenya, Russia, India, Malaysia, Philippines, Indonesia, Brazil, Colombia, Chile and Mexico)

These countries currently have low levels of digital advancement but are evolving rapidly. Their high momentum makes them attractive to investors. The constraints for these countries are relatively weak infrastructure and poor institutional quality.

Watch Out countries (examples- South Africa, Peru, Egypt, Greece and Pakistan)

These countries face significant challenges with their low state of digitalisation and low Momentum. in some cases, they are even moving backwards. The report notes that some of these countries demonstrate remarkable creativity in the face of severe infrastructural gaps, institutional constraints, and low sophistication of consumer demand. Improving access to the Internet would be the key to raise momentum.

Stand outs among the Stand Outs

DEI 2017 identifies three countries as standouts even within the Stand Out segment: Singapore, New Zealand, and the UAE. Each has a unique policy-led digital strategy and a narrative that could be considered as worthy of emulation or adoption.

The report highlights Singapore’s ‘Smart Nation’ developments and the use of numerous free trade zones, next-generation infrastructure, tax breaks, low import duties, and a strategic location by UAE to become an early adopter of a range of futuristic technologies, from self-driving cars to robot policemen. New Zealand is attracting tech talent by showcasing its physical distance from the rest of the world (also read this) and its superior and forward-looking institutions.

Digital Trust

DEI 2017 incorporates a newly devised analysis of ‘digital trust’, that takes into account the trustworthiness of the digital environment for each country; the quality of users’ experience; attitudes towards key institutions and organizations; and users’ behavior when they interact with the digital world. Trust is of high interest to all participants in the digital economy today, given the concerns about security of essential information, cyber-attacks, and consumers’ Apprehension about the digital systems and their reliability, the digital companies and their growing dominance, and about the leaders of digital companies.

There are four classifications here too: High Trust Equilibrium (Singapore, Spain, Norway, Hong Kong and Finland) with users that exhibit patient and engaged online behavior combined with a more trustworthy environment and relatively seamless experience; Low Trust Equilibrium where low user trust is aligned with the less trustworthy and friction-laden environment; Trust Surplus (China, Turkey, Malaysia) which have patient and engaged users despite high friction experiences and relatively less trustworthy environments; and Trust Deficit (South Korea,US, France, Australia), where users tend to be less patient and fickle when faced with friction online though the experience and environment in general are similar to the High Trust Equilibrium countries.

China, Switzerland, Singapore, and the Nordics score well on different metrics, but for different reasons. The report also says that the Chinese consumer is an outlier, demonstrating patient user behavior in the face of friction, such as slow internet speeds. Western and Northern European states lead in digital trust experience and environment scores, which reflect investments in strong security, privacy, and accountability measures, and in minimising friction.

In general, consumers were more tolerant of friction in their daily digital interactions in countries which have momentum.

Six key takeaways

The report provides six takeaways: 1) Use Public Policy as Key to the Success of the Digital Economy; 2) Identify What Drives Digital Momentum; 3) Jumpstart Small Country Growth by Involving Government; 4) Reinvent the Digital Stalwarts; 5) Play Digital Catch-Up by Closing the Mobile Internet Gap; and 6) Work Harder to Earn Users’ Trust.

Read the Digital Planet 2017 report here/ Find more information here.